in this guide

Employment income affects your payment from us. To make sure we’re paying you the right amount, we need you to report your and your partner’s gross employment income.

If you get Carer Payment, you can use your Centrelink online account to tell us when you or your partner start working, or to report your employment income each fortnight. You can also follow our online guide to report your paid employment income using the Express Plus Centrelink mobile app.

Gross income is the amount your employer pays you before tax and other deductions. You must report the gross income paid to you, and gross income paid to your partner, in your reporting period. You can find your gross pay amount on your payslip.

You need to submit your report on or after your reporting date.

To make sure you get paid on time, you must submit your report by 5 pm local time on your reporting date. Read more about employment income reporting.

You may have to report in a different way based on your personal circumstances. Some steps in this guide may not apply to you.

Some employers use Single Touch Payroll (STP). This means they send your information to us and the Australian Taxation Office (ATO) automatically. We use it to pre-fill information in your employment income report. You can review the information before you continue and then complete your report. You may need to change or add details so your report is complete and correct. The information we have depends on how your employer does their payroll reporting. After you review and submit the information, it’ll pre-fill into your employment income report. If you have a partner, we won’t pre-fill their information for you to review.

The screenshots in this guide are from a computer. The screen layout will look different if you’re using a mobile device.

Step 1: get started

Sign in to myGov or the myGov app and select Centrelink.

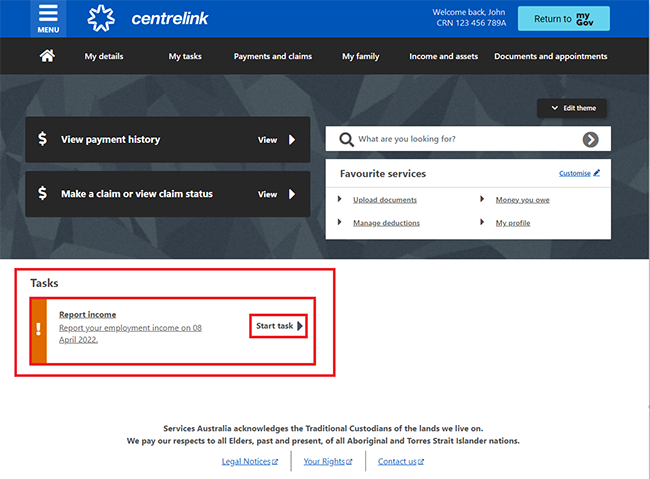

There are 2 ways to start, using either:

Using Tasks

From the Report income task, select Start task.

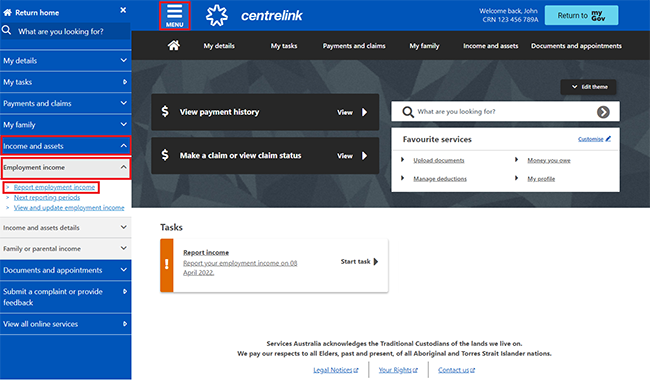

Using MENU

Select MENU, followed by Income and assets, then Employment income and Report employment income.

Step 2: confirming pre-filled employment details from your employer

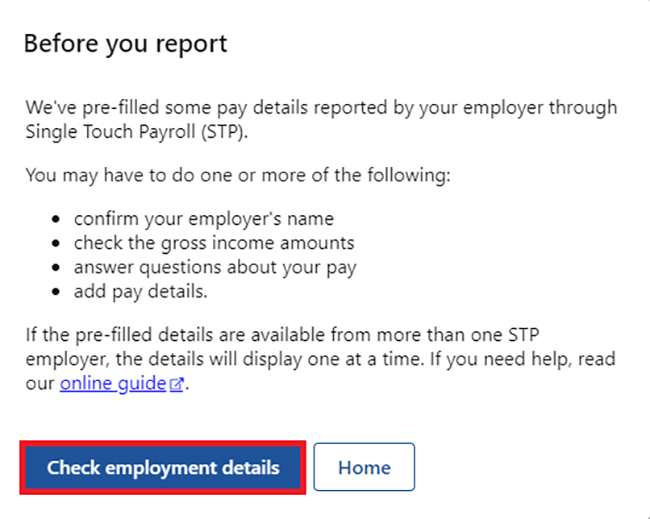

A Before you report message will tell you there’s pre-filled employment information to check if employment details are available from your employer.

If we don’t show pre-filled information, go to Step 3.

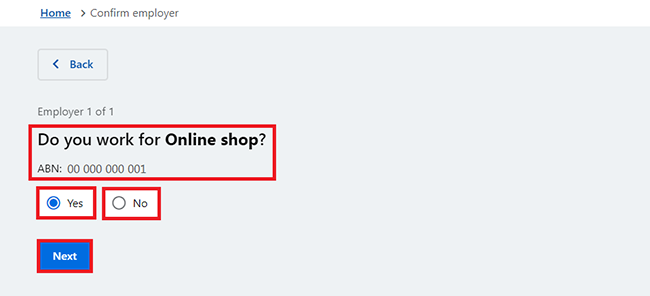

When your employer gives us your details for the first time, we’ll show your employer’s name and Australian Business Number (ABN) or Withholding Payer Number (WPN). You must confirm if you work for them. We won’t pre-fill your employment income until your next report.

Employers may have a different trading name to their registered business name. If you don’t recognise the employer name, we’ll show different business or trading names of the employer.

If you have more than one Single Touch Payroll employer, you’ll need to confirm the pre-filled information for each employer, one at a time. We won’t pre-fill your partner’s employer details. If you need help, read the information with the question mark icon on each page.

On your next reporting date, we’ll tell you we’ve pre-filled some pay details and what you may need to do. Select Check employment details.

We’ll show your employer’s name and Australian Business Number (ABN) and ask if you work for them.

Select either:

- Yes if you work for the employer shown

- No if you don’t work for the employer shown.

Then select Next.

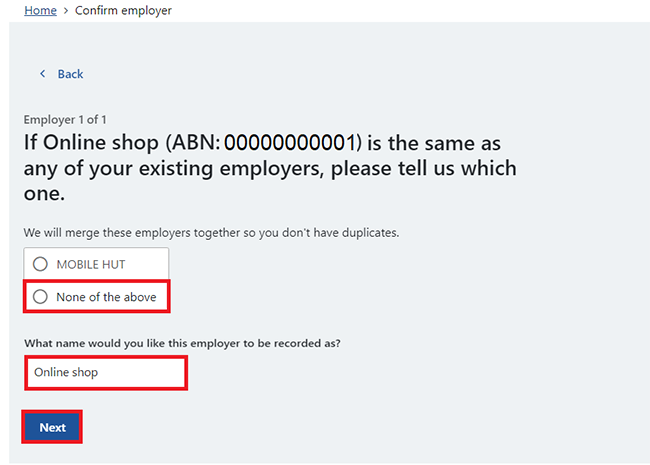

If you’ve already told us about your employer, select them from the list. We can then match the employer on your record.

If they’re not in the list, select None of the above and enter the name you want us to record your employer as.

Then select Next.

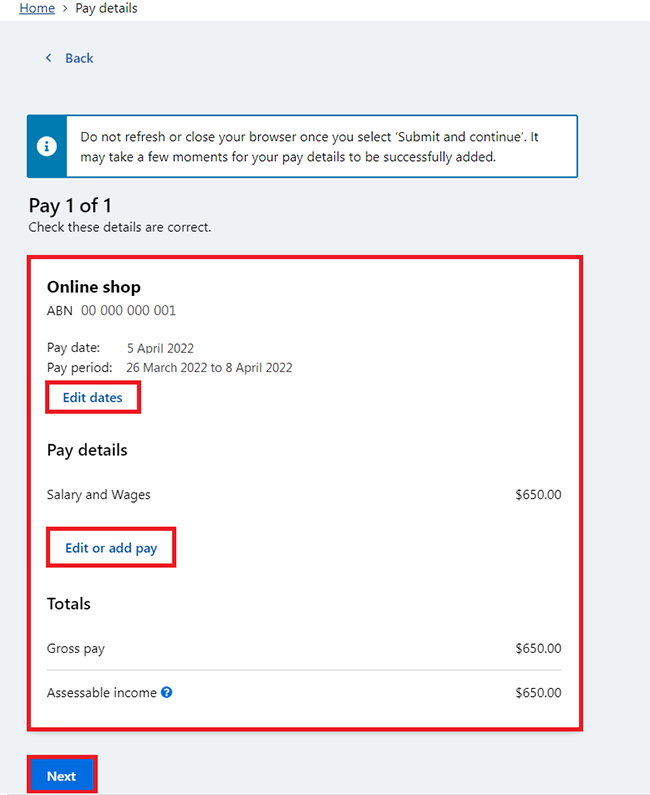

We’ll show the following pay details:

- Pay date

- Pay period

- Pay types, for example, salary and wages, and paid leave

- Gross pay, this is the amount before tax and any other deductions

- Assessable income

- Non-assessable income, if applicable.

Check your payslip if you’re unsure about the pre-filled details shown.

If any details are wrong or not pre-filled, you’ll have to make changes. Select either:

- Edit dates to make changes to the pay period, you won’t be able to change the pay date

- Edit or add pay to make changes to the pre-filled income details or to add pay for this employer.

If you make changes, we may ask you to give us proof.

If you were paid more than once by this employer in the reporting period, we’ll show the pay details one at a time for you to review.

Select Next to continue.

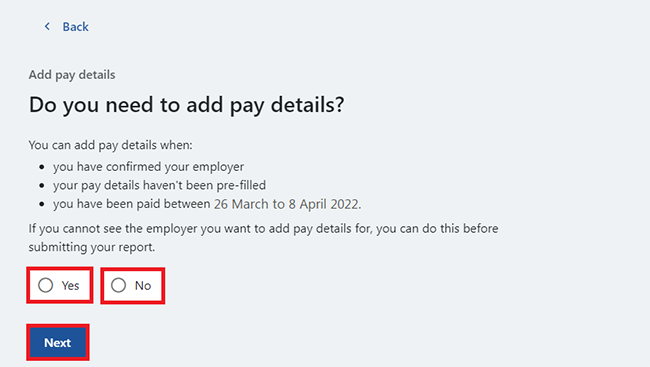

Select Yes or No to tell us if you need to add pay details for this employer.

If you select Yes, you can only add pay details for the Single Touch Payroll employer you’re currently editing. You can add any pay type that hasn’t been pre-filled if you were paid within the reporting period. This includes all income, such as bonuses, commission income and termination payments you got from your Single Touch Payroll employer.

Then select Next.

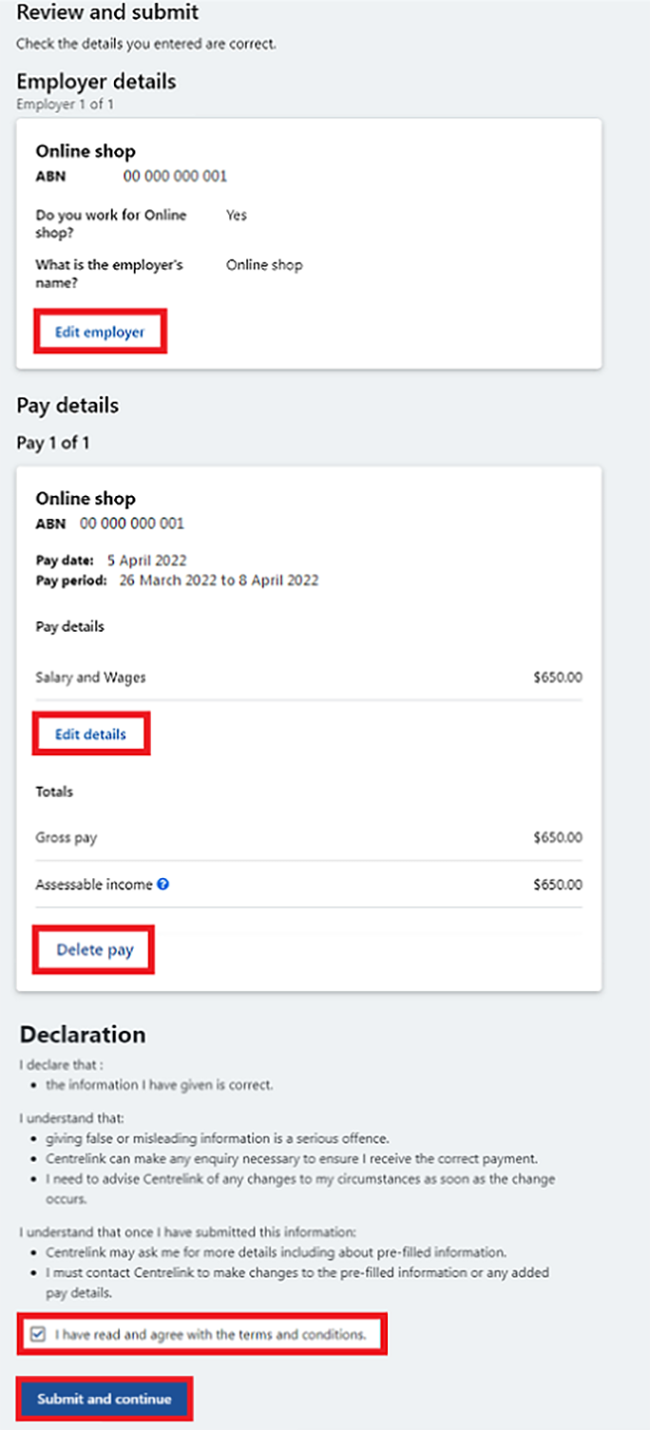

We’ll show you a summary of your pre-filled employer and pay details. Review each section to check all the details are correct.

If you manually added pay details, you’ll have the option to Delete pay. You can add them again if you entered them wrong.

If you need to make changes, select either:

- Edit employer to make changes to your employer

- Edit details to make changes to your pay.

If you make changes, we may ask you to give us proof.

Read the declaration. If you understand and agree with the declaration, select I have read and agree with the terms and conditions. Then select Submit and continue.

When you select Submit and continue, you’re only confirming the Single Touch Payroll employment details. You won’t be able to change these details after you submit them. After you submit, you must complete the rest of your report.

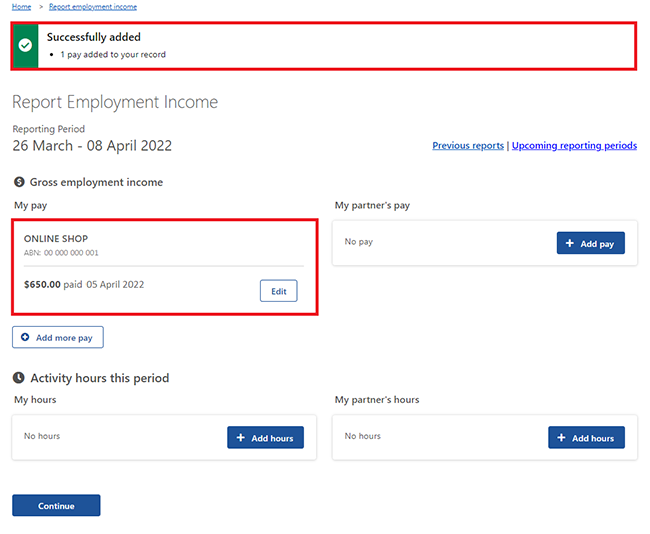

We’ll let you know all the following:

- your gross pay was successfully added to your record

- your employer’s details

- the amount and date of your gross pay.

We won’t show any not assessable income you told us about earlier on this page. Income that is not assessable isn’t used to work out your rate of payment and entitlement.

Go to Step 3 to continue your report.

Step 3: report non-pre-filled employment income

You can’t enter some employment income types, such as bonuses, commission income or termination payments for non-Single Touch Payroll employers. To tell us about other paid employment income, use the Manage income and assets service.

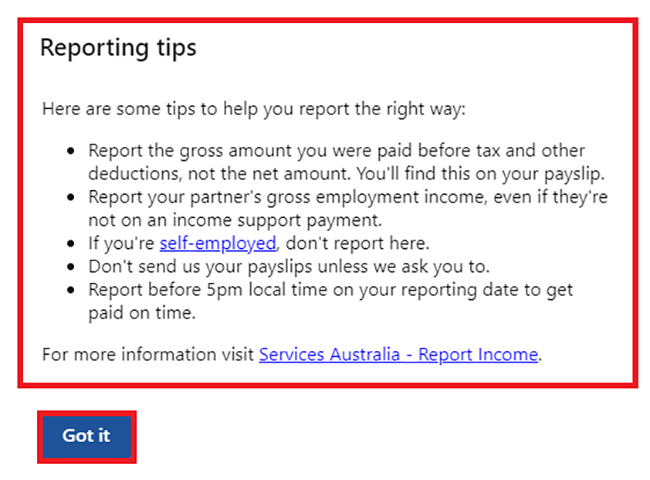

We may show some Reporting tips to help you report the right way. If you get this message, please read it, then select Got it to continue.

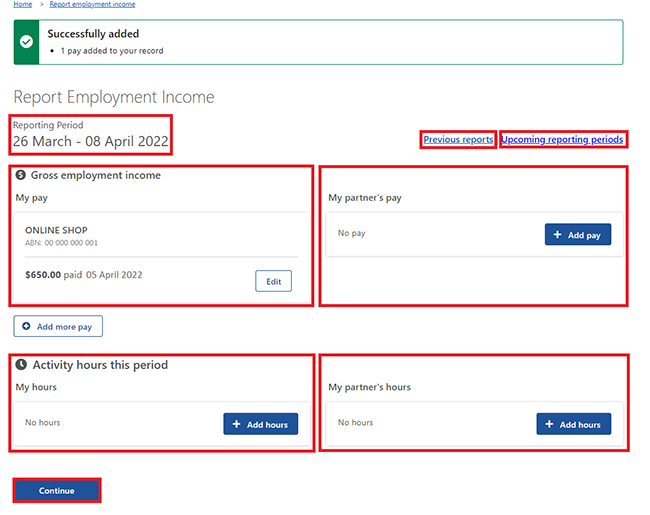

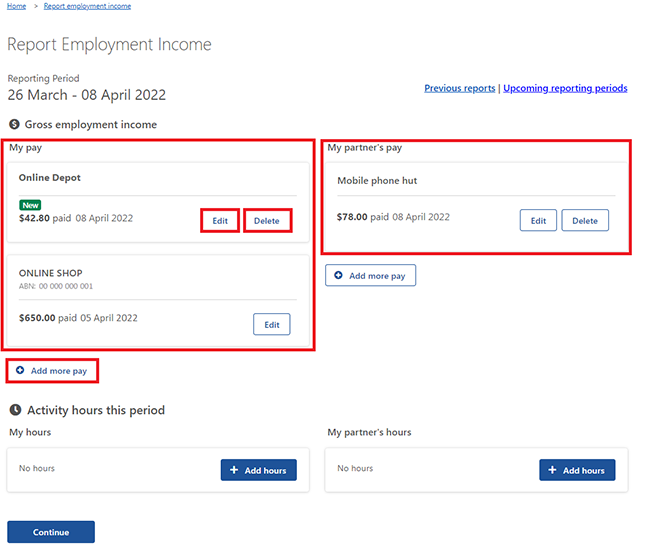

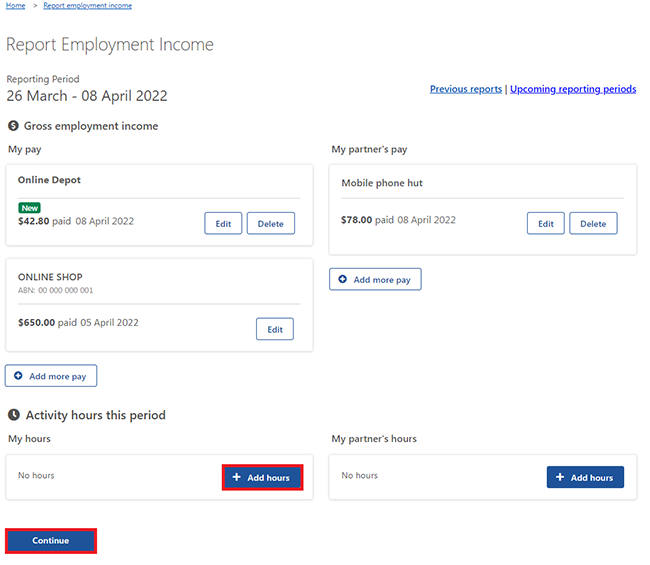

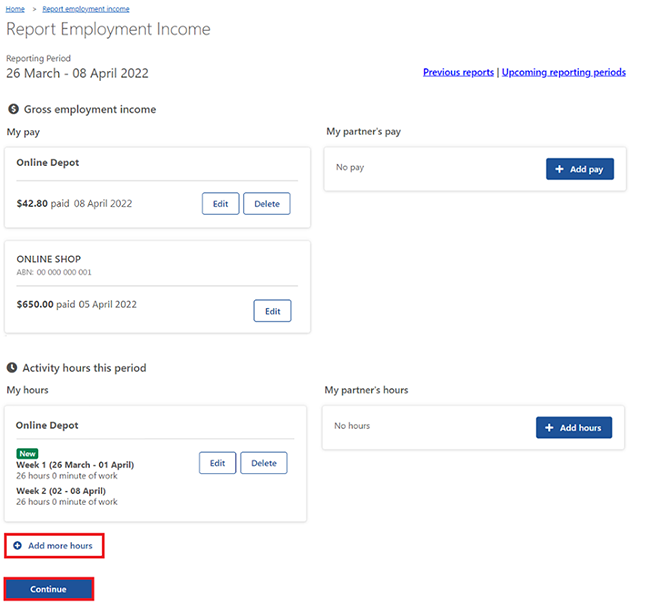

The Report Employment Income page will show all of the following:

- any Single Touch Payroll income details you confirmed

- your reporting period

- a Gross employment income section for you and your partner

- an Activity hours this period section for you and your partner.

The Activity hours this period section won’t show if you transferred to Carer Payment on 20 March 2020 because you were getting both:

- Wife Pension

- payment level Carer Allowance.

You can also select either of the following:

- Previous reports to view and change income you reported for up to 6 of your past reporting periods. This doesn’t include Single Touch Payroll employers.

- Upcoming reporting periods to view up to 6 of your future reporting periods.

If you’re on:

- scheduled reporting, submit your report on the date it’s due

- unscheduled reporting, you can use this service any time to let us know what you’ve been paid. You need to do this within 14 days of being paid.

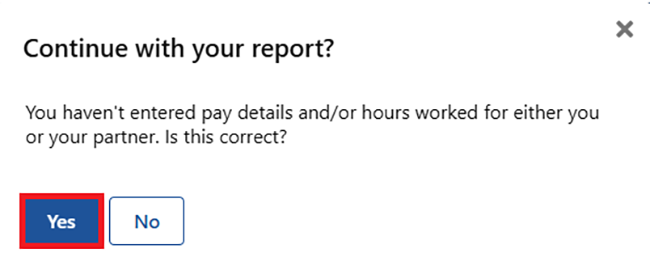

If you and your partner didn’t get paid any other employment income in your reporting period, and didn’t work any hours, select Continue. A Submit partial report message may appear. This is a prompt for you to check that everything you need to tell us is included.

If you or your partner get Carer Payment, you must report any hours worked, even if you or your partner weren’t paid.

If you don’t need to include anything else, select Yes to continue.

If you do have other employment income to report, select Add more pay in Gross employment income.

You need to include all the following:

- any gross income you were paid in the reporting period

- any gross income your partner was paid in the reporting period

- any gross income your employer back paid you or your partner

- the hours both you and your partner worked, if required.

If you’re waiting for back pay, don’t report this as income until you get it.

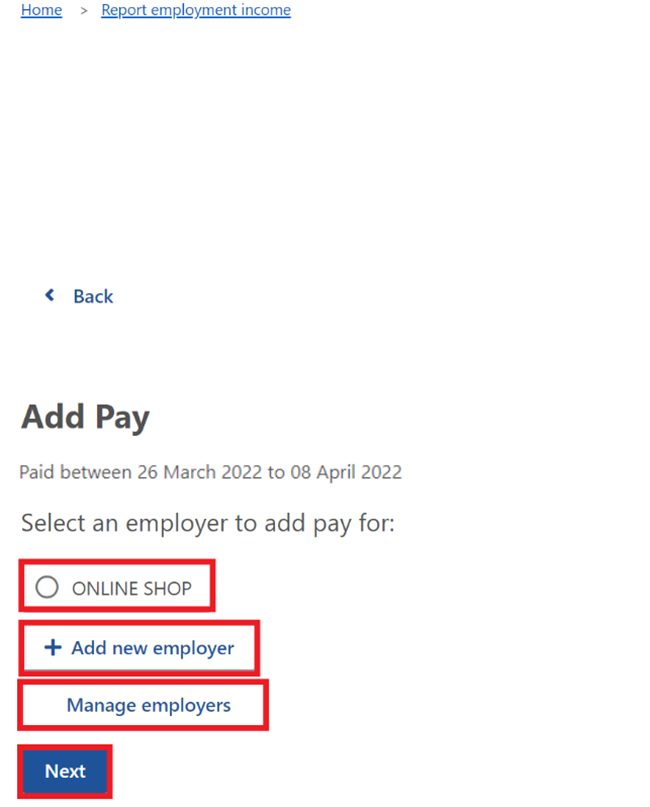

You can select one of the following:

- your employer from the list, then select Next to add your pay

- Add new employer if your employer doesn’t appear on the list

- Manage employers to remove an employer.

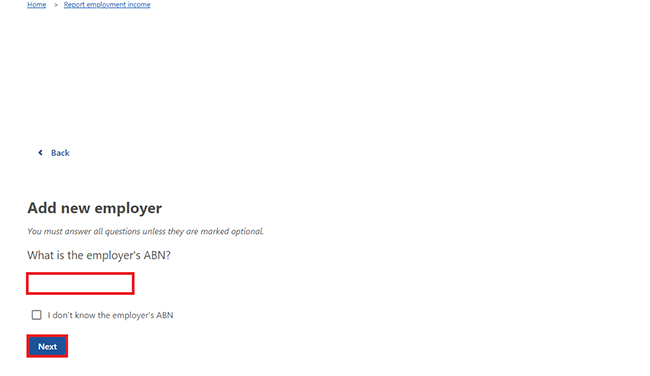

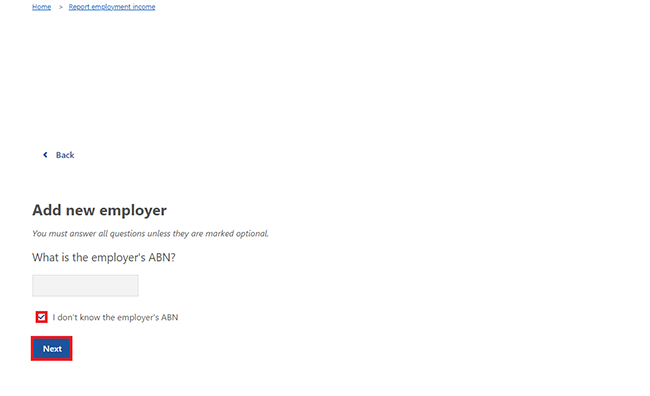

Add new employer

You can add a new employer for you or your partner.

Enter your employer’s ABN (Australian Business Number). You can find this on your payslip. Then select Next.

If you can’t find your employer’s ABN, select I don’t know the employer’s ABN, then Next.

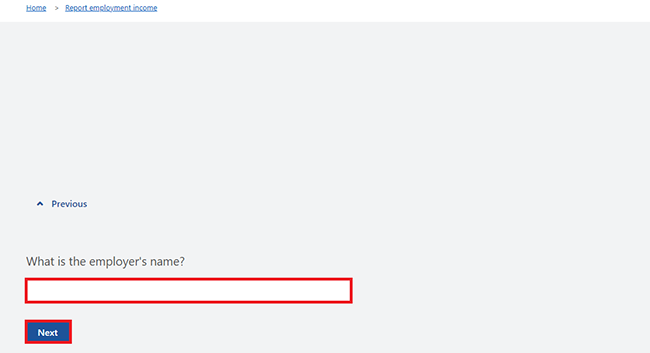

Enter the employer’s name, then select Next.

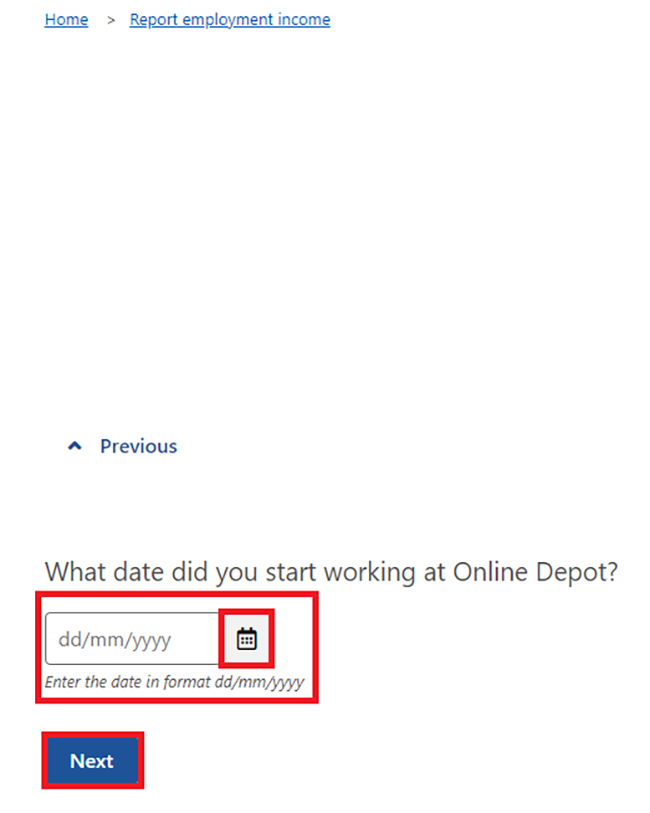

In this example, the employer’s name is Online Depot.

Select the calendar icon and enter the date you began working for your new employer. Or, enter it manually in the format of dd/mm/yyyy.

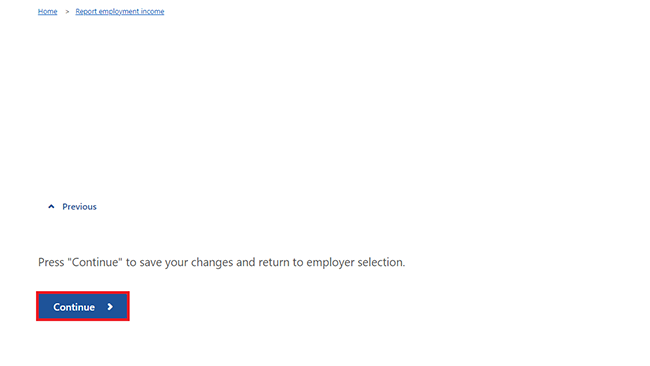

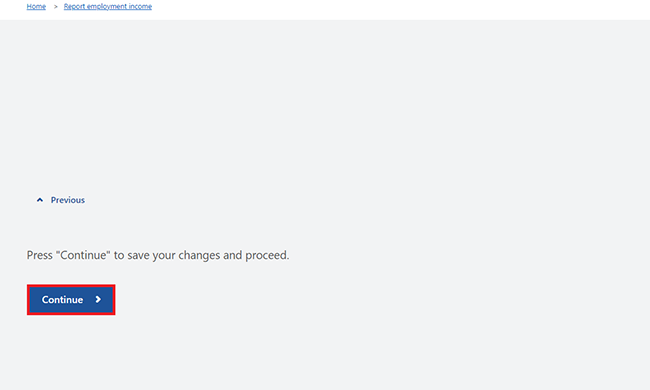

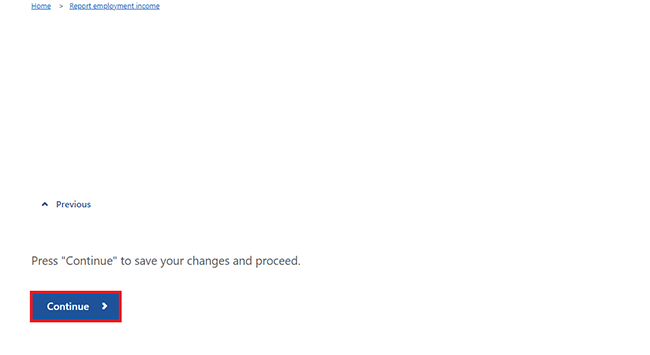

Select Continue to save your changes and proceed.

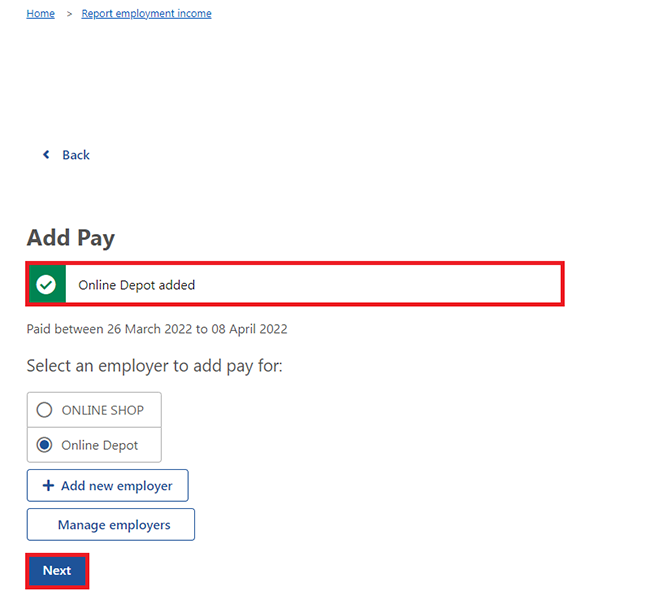

Your new employer will appear on the Add Pay page.

Select Next to continue.

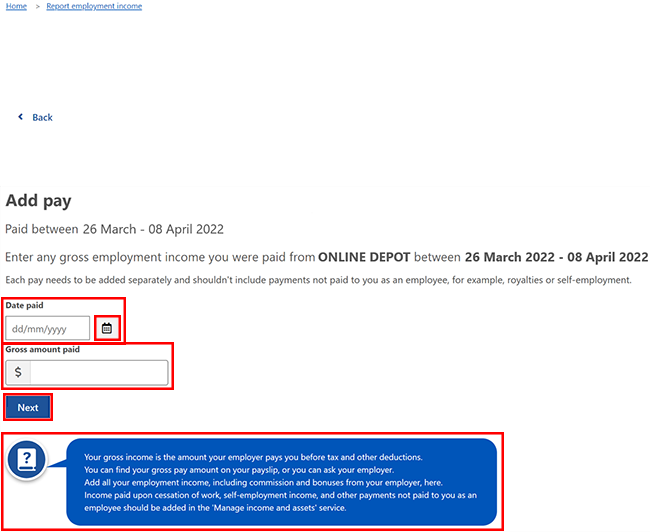

Add pay

If you need help, read the information with the question mark icon on each page.

In this reporting period, if you or your partner got paid more than once by the same employer, you’ll need to add each pay separately. If you have more than one job, you’ll need to add the income you got from each employer separately.

Select the calendar icon and choose the date your employer paid you, as stated on your payslip. This date can be different to when the payment goes in your bank account. Or, enter it manually in the format of dd/mm/yyyy.

Enter the Gross amount paid, before tax and deductions. You can find this on your payslip. Use Australian dollars and cents, including the decimal point.

Then select Next.

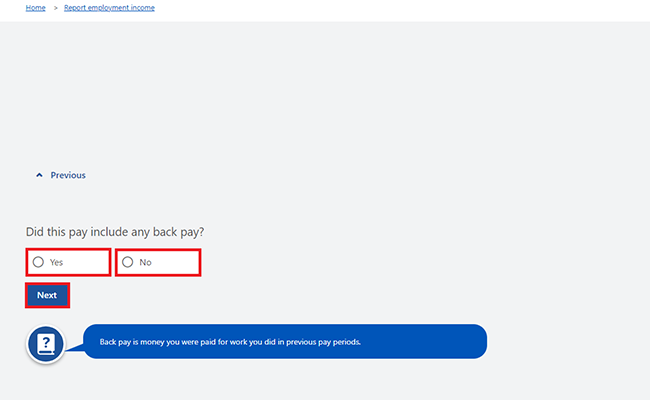

Select Yes or No to tell us if this pay includes any back pay.

Then select Next.

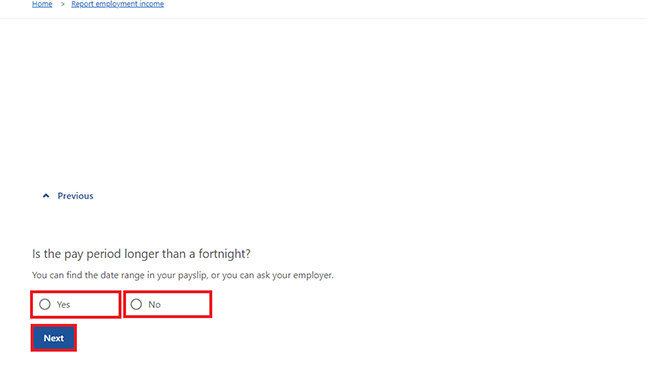

Select Yes or No to tell us if your employer’s pay period is longer than a fortnight.

Then select Next.

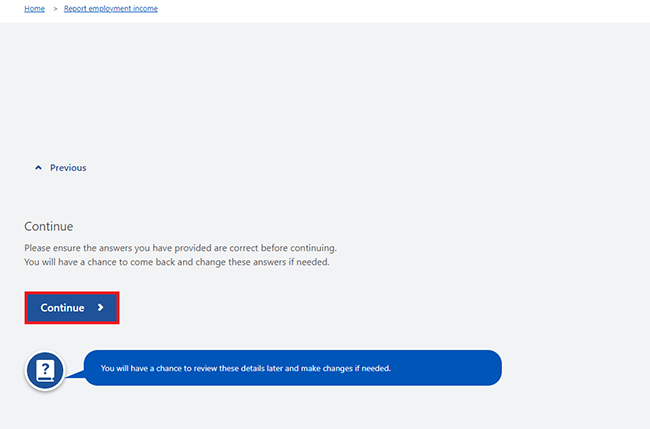

Select Continue to proceed.

We’ll give you a summary of the details you’ve added.

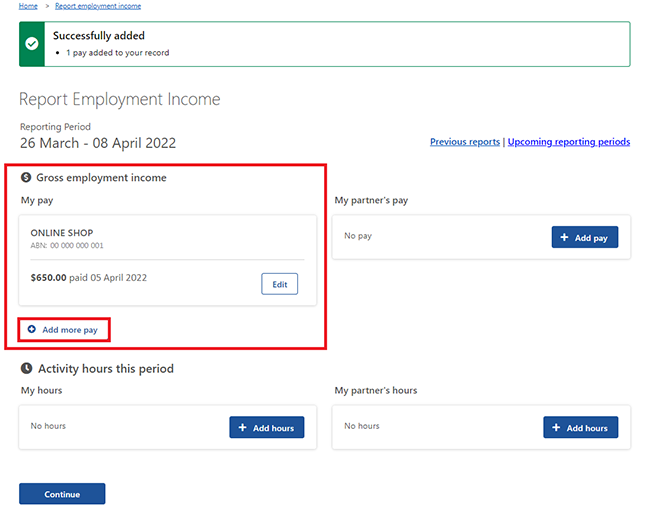

Your total income for each employer will show in Gross employment income under My pay.

If you’ve reported your partner’s income, that will be under My partner’s pay.

On this page, you can change the details you’ve added in your reporting period. Select any of the following:

- Edit if you need to change the non-pre-filled details you’ve given us for you and your partner

- Delete if you need to remove the details you’ve given us for you and your partner

- Add more pay if you have more than one job, to enter income from a different employer

- Add more pay if you got paid more than once by the same employer.

If you’ve started working for a new employer and haven’t been paid yet, select Add hours and enter your new employer details, including the hours you spent away from your care receiver doing paid employment.

If you transferred to Carer Payment on 20 March 2020, in some situations you don’t need to tell us your hours. This applies to you only if you were getting both:

- Wife Pension

- Carer Allowance payment.

If you don’t need to report hours worked, the Add hours option won’t appear.

Even if you don’t have any paid income, you still need to report the hours you spent away from your care receiver to work.

Select either of the following:

- Add hours to add activities spent away from your care receiver

- Continue if you don’t have any paid income or hours to report.

Select Yes and go to Step 4.

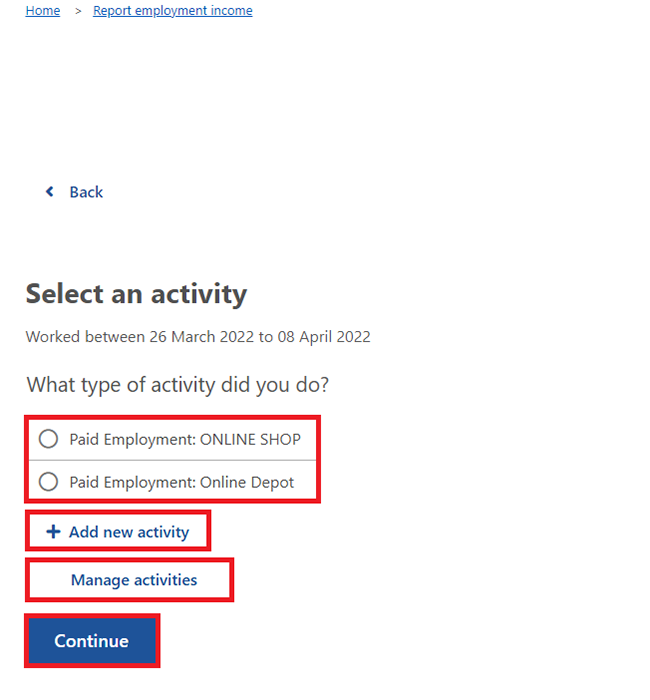

Add activities

Select each type of activity shown, one at a time. If you didn’t do any hours in the reporting period for an activity type shown, select it and enter zero.

Then select Next.

You can also select either:

- Add new activity to add a new activity

- Manage activities to remove an activity.

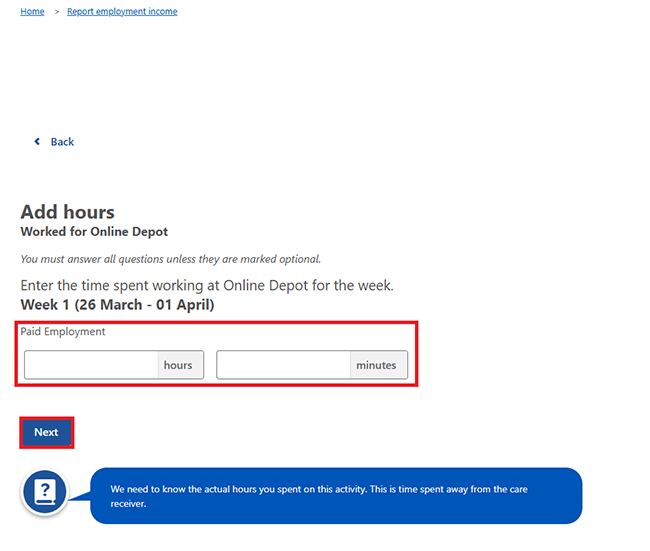

We may ask you to enter the hours and minutes you spent doing an activity away from the person you provide care for.

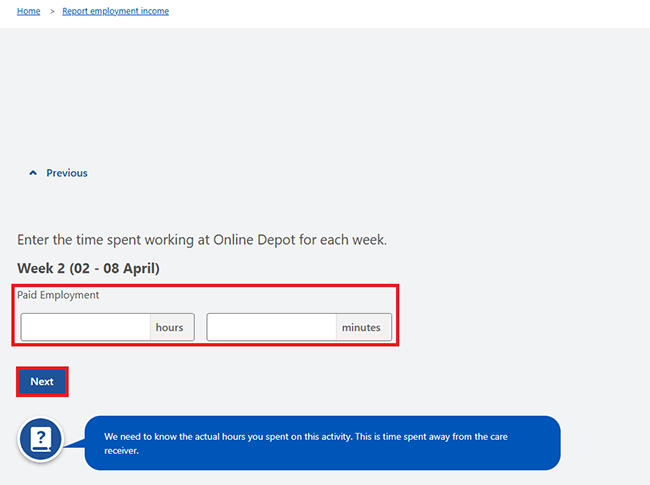

If we pre-fill your hours and they’re wrong, enter the correct hours. This includes changing the hours to zero if you didn’t work any hours. If we don’t pre-fill your hours, enter the hours you did away from your care receiver. In this example, we’ll select the activity of Paid Employment: Online Depot. You’ll also need to update other activities that appear in the list.

Enter the activity hours to do this paid employment in hours and minutes.

Enter this information for Week 1, then select Next.

Enter the activity hours to do this paid employment in hours and minutes.

Enter this information for Week 2, then select Next.

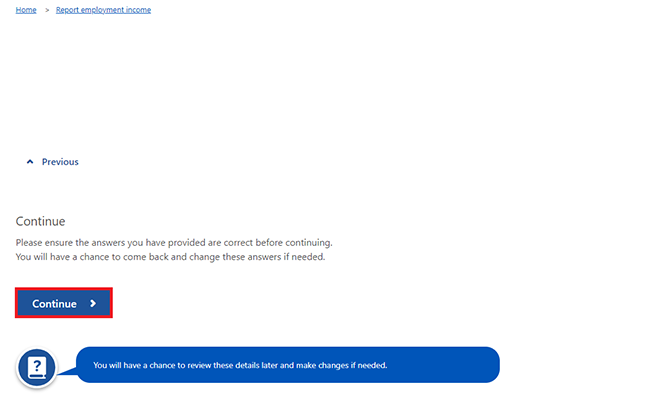

Select Continue to proceed.

If you or your partner worked for more than one employer, select Add more hours to enter hours for other employers.

When you’ve finished adding your or your partner’s hours worked, select Continue.

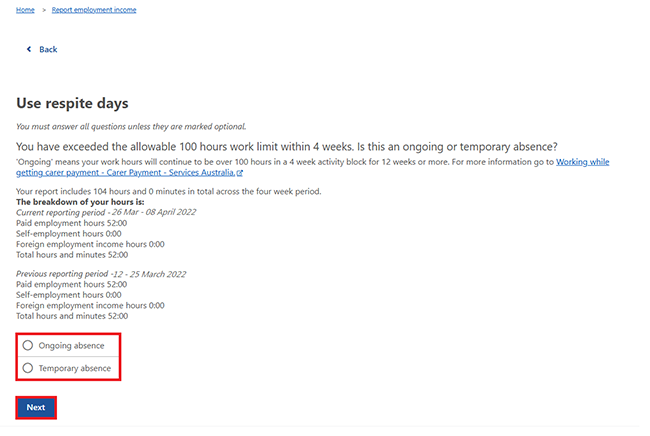

If your paid work, including self employment, is not more than 100 hours in a 4 week period, go to Step 4 to review and submit your information.

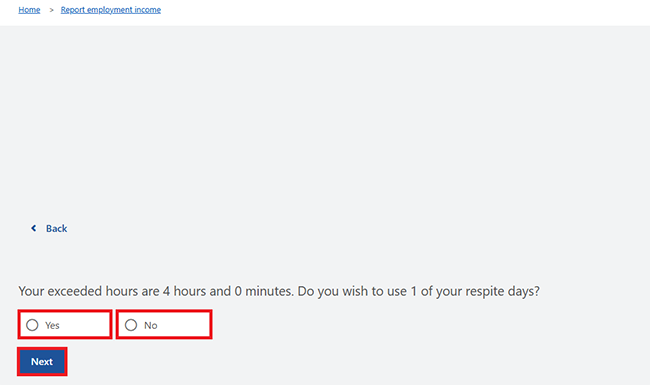

If your paid work, including self employment, is more than the allowable 100 hours in a 4 week period, the Use respite days page will appear.

Select either:

- Ongoing absence if your work hours will continue to be more than 100 hours in a 4 week activity block for more than 12 weeks

- Temporary absence if your work hours are more than 100 hours in a 4 week block for less than 12 weeks.

For temporary absences, you may have an entitlement to Breaks from caring.

Paid employment hours include all hours for all your listed employers. If these are wrong, you’ll need to go back and check the hours for each of your employers.

Then select Next.

If you chose Ongoing absence, select Continue and go to Step 4 to review and submit your information.

If you chose Temporary absence, select Yes or No to tell us if you want to use respite days you’re eligible to take.

In this example, we did more than 100 hours in a 4 week period.

Then select Next.

Select Continue and go to Step 4 to review and submit your information.

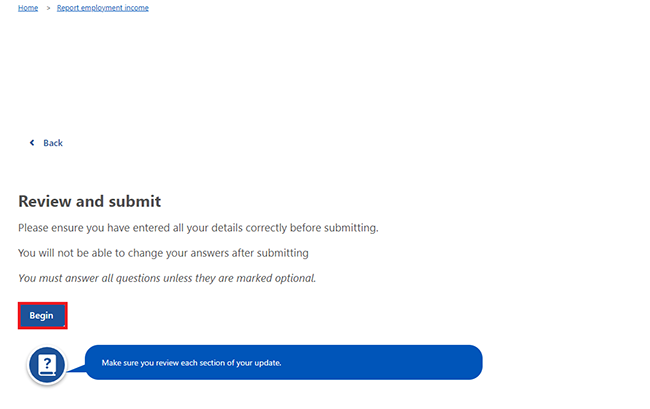

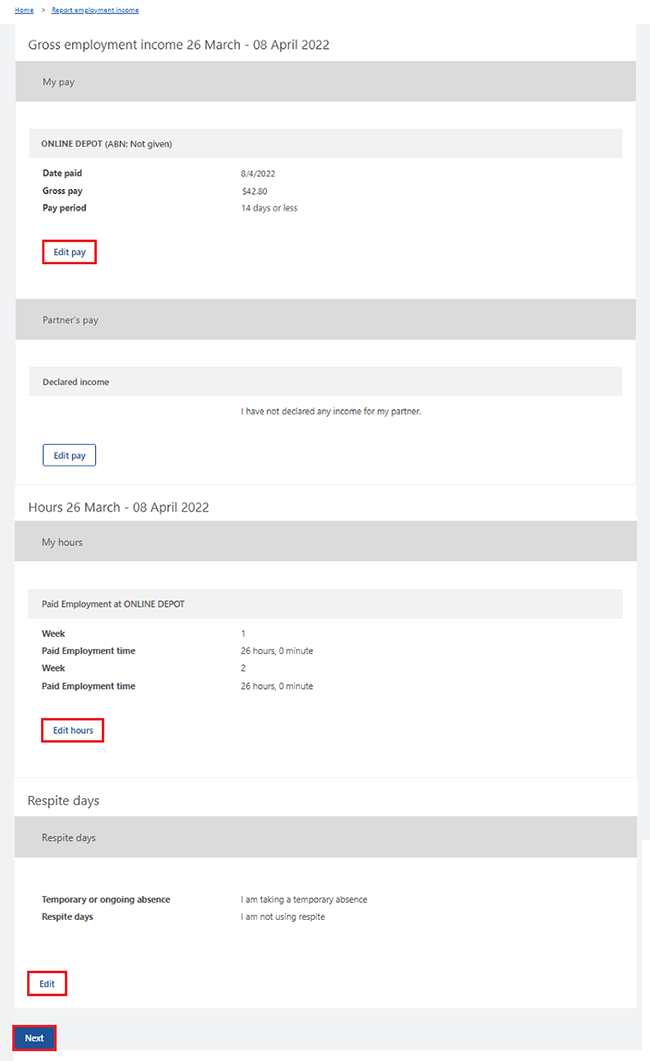

Step 4: review and submit your update

Select Begin to check your updates are correct.

We’ll give you a summary of the details you’ve given us.

Review each section to check your details are correct. You won’t be able to change any pre-filled details you already submitted.

If you need to make changes to any details you gave us, select either of the following:

- Edit pay if you need to change your pay

- Edit hours if you need to change your hours

- Edit if you need to change your respite days.

If the details are correct, select Next.

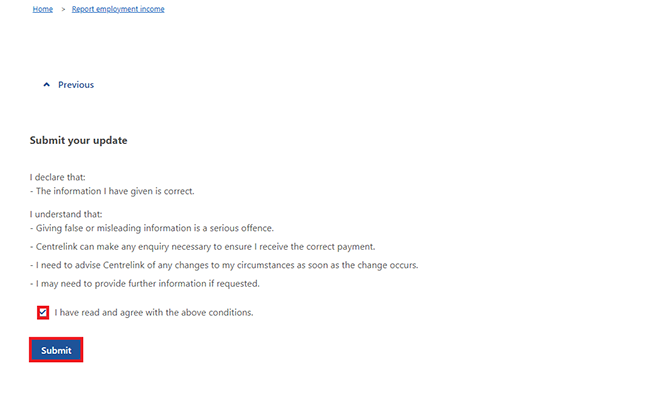

Read the declaration. If you understand and agree with the declaration, select I have read and agree with the above conditions.

Then select Submit.

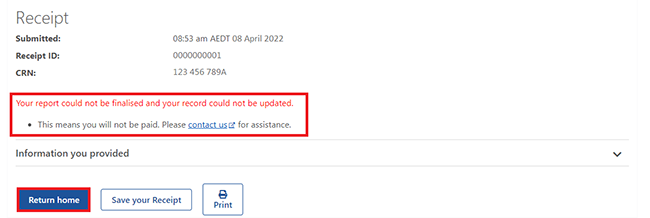

We’ll tell you if your report can’t be finalised. If it can’t, you’ll need to call us on the Centrelink reporting line to complete your report.

Select Return home to go back to your homepage, then go to Step 5 to sign out.

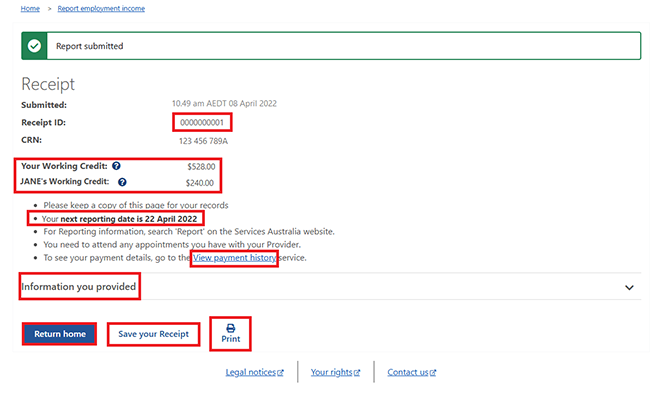

Get your receipt

We’ll give you a receipt when you submit your report. Make a note of the Receipt ID for your records.

Your receipt will include the following:

- your Working Credit or Work Bonus balance

- your next reporting date

- information you need to know based on your circumstances

- your next payment amount if it’s zero

- a link to the View payment history service to check your next payment details.

Payment amounts of zero won’t show in the View payment history service.

Your receipt may also show your partner’s:

- Working Credit, Work Bonus or Income Bank balance

- next payment if it’s zero.

These details will show if they get a payment, and they permit you to access their information.

Select any of the following:

- Information you provided to view a summary of your income details

- Return home to go back to your homepage, then go to Step 5 to sign out

- Save your Receipt to keep a copy of your receipt

- Print to print your receipt.

Step 5: sign out

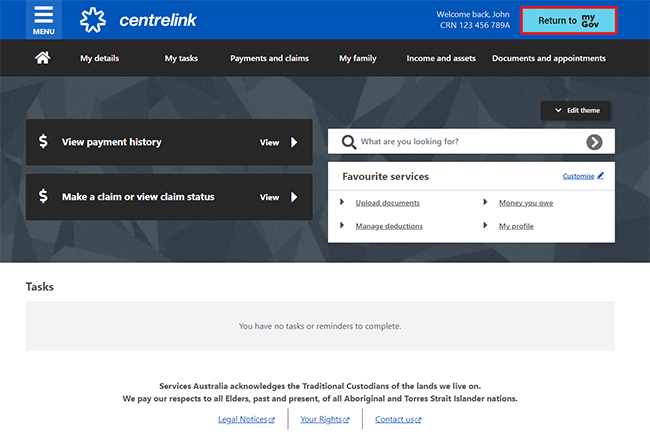

From your homepage, you can complete other transactions or select Return to myGov to go back to your myGov account.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus mobile app guides and video demonstrations about using your online account.

Contact numbers available on this page.

Centrelink reporting line

Use this line to report your employment income or tell us if you've met your mutual obligation requirements.

There are other ways you may want to contact us.