in this guide

Read more about advance payments including eligibility.

If you have a nominee, you can’t apply for an advance using your Centrelink online account. Correspondence nominees can apply for an advance for the person they’re acting for.

If you’re getting the Home Equity Scheme, there are different rules that apply to the Home Equity Scheme advance payment.

The screenshots in this guide are from a computer. The page layout will look different if you’re using a mobile device.

Watch this video about how to:

- apply for an advance payment

- adjust your advance repayments

- make an advance repayment.

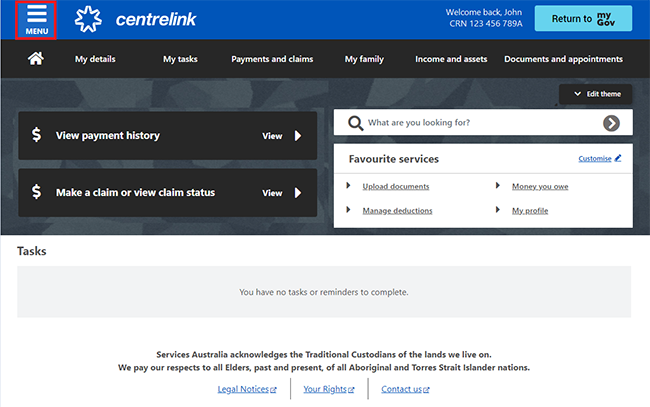

Step 1: get started

Sign in to myGov or the myGov app and select Centrelink.

From your homepage, select MENU.

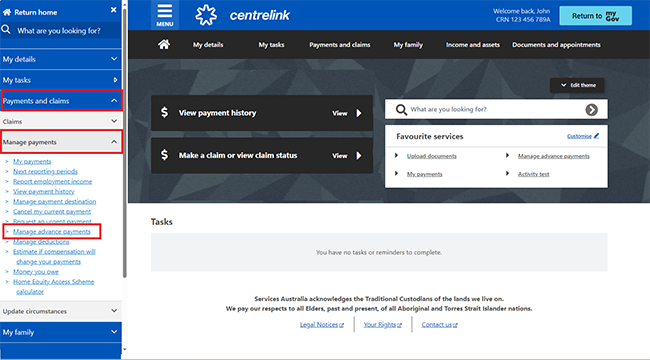

Select Payment and claims, then Manage payments and Manage advance payments.

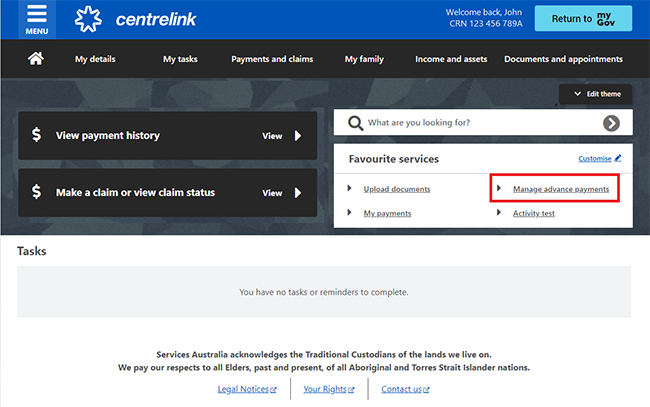

Or, select Manage advance payments in Favourite services. You can only do this if you have it saved as a favourite service.

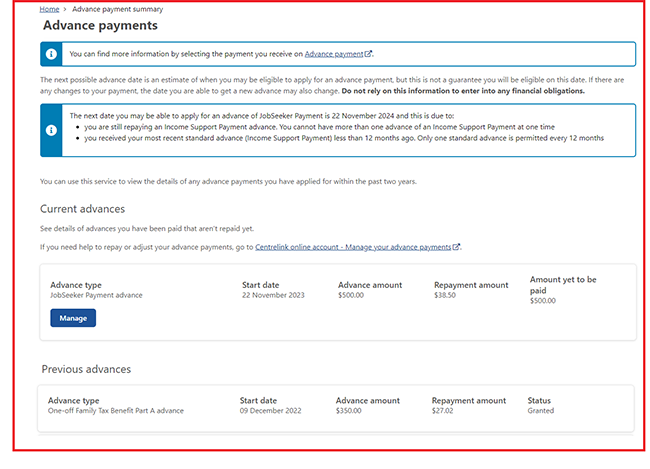

Step 2: view advance payments

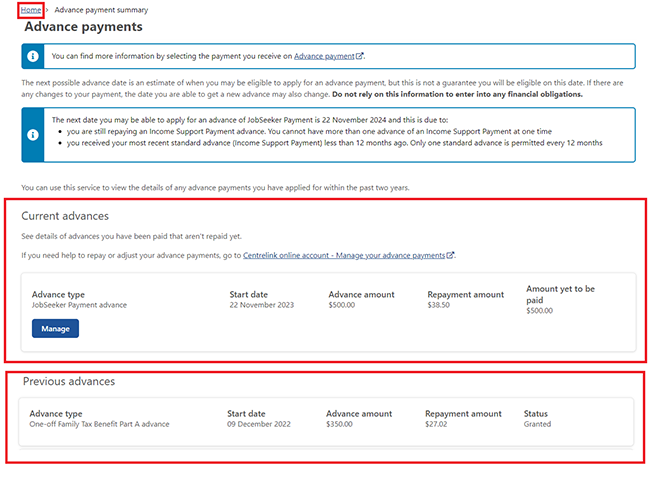

The Advance payments page has information about your current and previous advances.

If you have a current advance payment, the summary page will show:

- the advance type

- the start date

- the amount advanced to you

- your fortnightly repayment amount

- the amount yet to be paid

- when you can apply for your next possible advance.

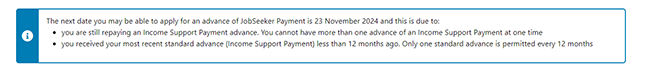

If you aren’t eligible to apply for an advance payment, we’ll tell you:

- why you’re not eligible

- when you may be eligible to apply.

If you aren’t eligible for an advance payment, go to Step 6 to sign out.

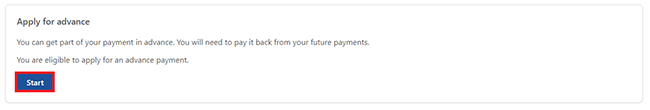

If you’re eligible, go to Step 3.

Step 3: apply for advance

Select Start.

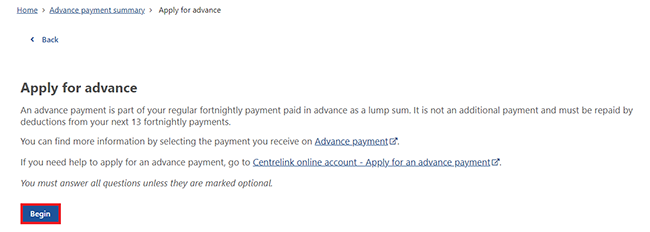

Read the information about advance payments, then select Begin.

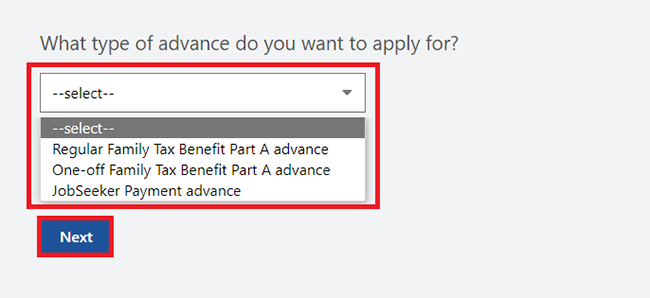

Select the type of advance payment you want to apply for, then select Next.

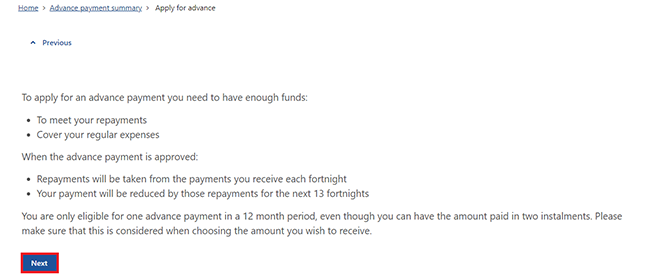

Read the eligibility requirements, then select Next.

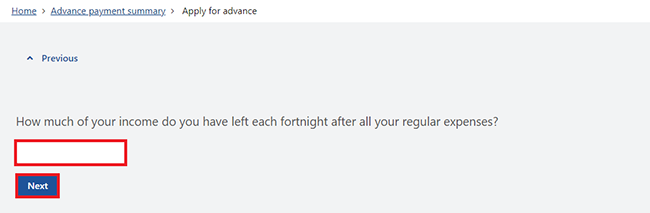

Enter how much money you have left over every fortnight after paying all your regular expenses. Regular expenses include food, rent, travel, electricity and phone, Centrelink repayments and all ongoing expenses and payments.

Enter the amount in dollars and cents, including the decimal point, then select Next.

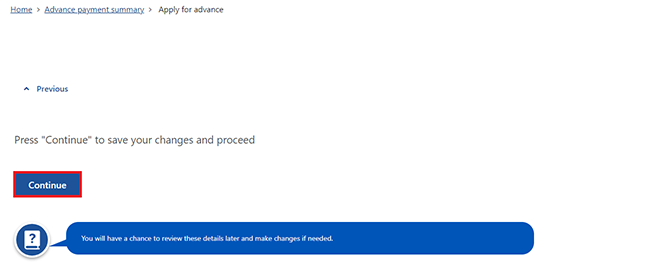

Select Continue to proceed.

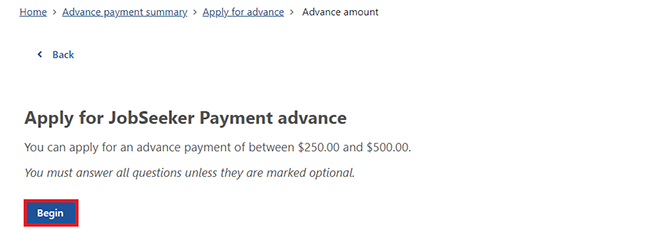

Read the information about how much you can apply for, then select Begin.

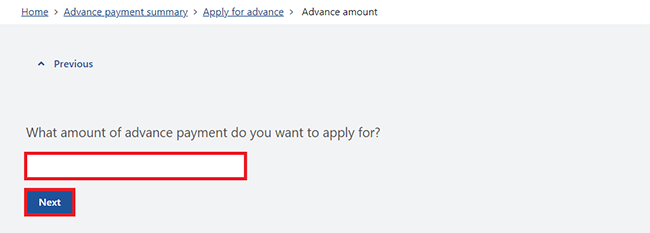

Enter the advance amount you want to apply for, then select Next. The amount you apply for must be within the advance amount payment range.

Enter the advance amount you want to apply for, then select Next. The amount you apply for must be within the advance amount payment range.

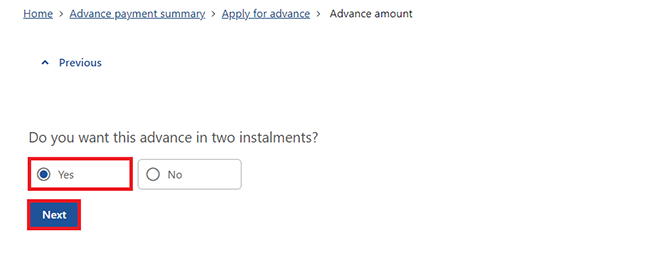

Depending on the type of advance, you can get your advance payment as either:

- one instalment

- 2 instalments.

If you want us to pay you in 2 instalments, you’ll need to tell us:

- the amount of your first instalment

- the date you would like the second instalment.

In this example, we’ll choose to be paid in 2 instalments. Enter these details, then select Next.

If you’re applying for a Family Tax Benefit advance, we can only pay this in one instalment.

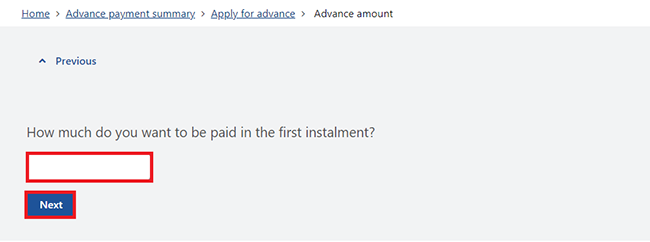

Enter how much you want to be paid in the first instalment, then select Next.

Enter how much you want to be paid in the first instalment, then select Next.

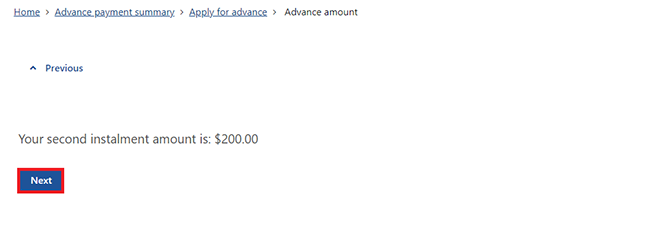

We’ll tell you how much your second instalment amount is. Select Next to continue.

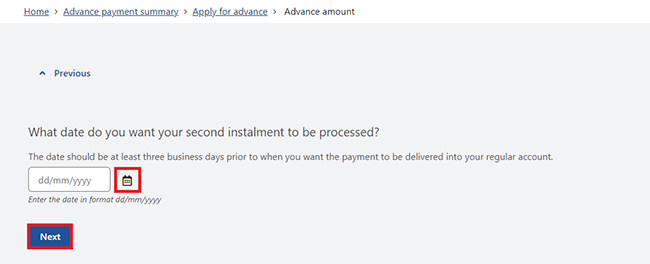

Select the calendar icon and enter the date you want to get your second instalment processed, then select Next.

Select the calendar icon and enter the date you want to get your second instalment processed, then select Next.

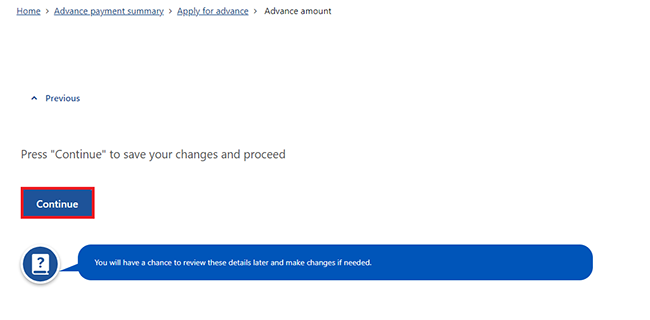

Select Continue to proceed.

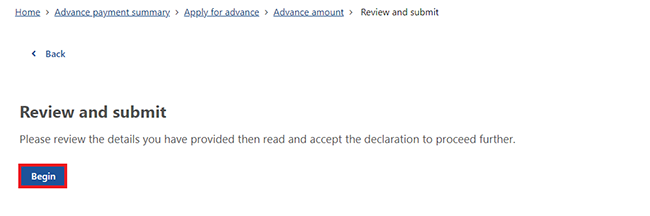

Step 4: review and submit

Select Begin to review and submit your advance payment application.

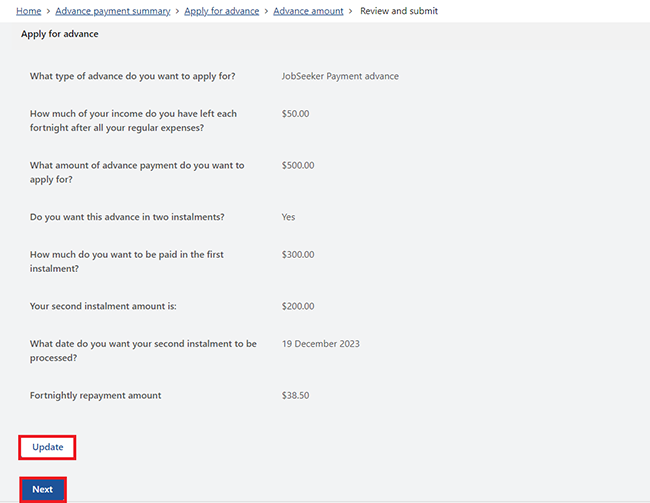

We’ll give you a summary of the details you’ve provided.

We’ll also tell you your fortnightly repayment amount. Your repayment is taken from the amount we’d normally pay you. You don’t need to do anything to set this up.

Read the details on this page and make sure they’re correct, then select Next. If you need to make changes, select Update.

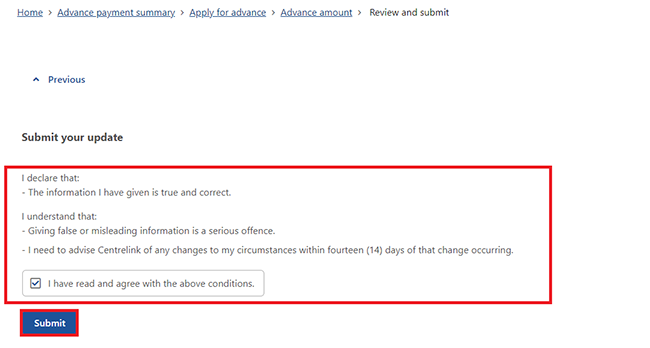

If all the information is correct, read the declaration. If you understand and agree with the declaration, select I have read and agree with the above conditions, then Submit.

If all the information is correct, read the declaration. If you understand and agree with the declaration, select I have read and agree with the above conditions, then Submit.

Step 5: get your receipt

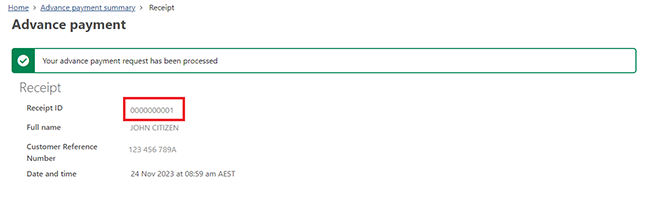

We’ll give you a receipt to let you know your application has been processed. Make a note of the Receipt ID for your records.

You don’t need to contact us about your advance payment unless we ask you to.

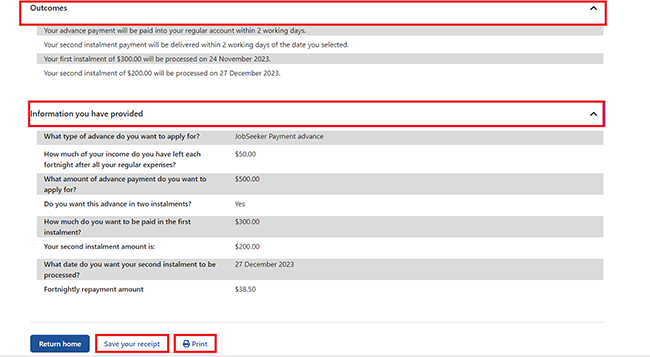

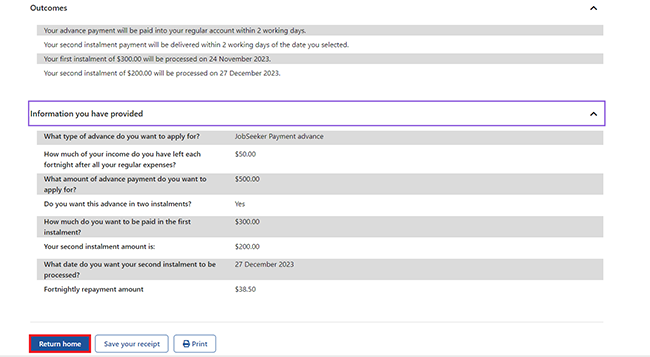

Select any of the following options:

- Save your receipt to keep a copy of your receipt

- Print if you want to print your receipt

- Outcomes to view more details about your advance payment

- Information you provided to view a summary of the details you’ve given us.

Select Return to home to go back to the Advance payments page.

On the Advance payments page, we’ll give you a summary of your current and previous advance payments.

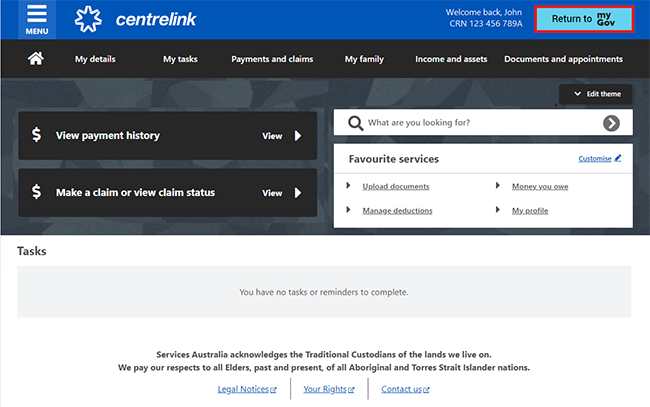

Select Home to go back to your online account homepage.

Step 6: sign out

From your homepage you can complete other transactions or select Return to myGov to go back to your myGov account.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus mobile app guides and video demonstrations about using your online account.