in this guide

Use this service if you got Family Tax Benefit (FTB) or Child Care Subsidy (CCS) in a previous financial year.

So we can balance your FTB or CCS you need to tell us both of the following:

- if you or your partner are not required to lodge a tax return

- your or your partner’s income for a previous financial year, if a tax return is not required.

Read more about:

If you’re not sure if you need to lodge a tax return, there’s help available. Use the Do I need to lodge a tax return? tool on the Australian Taxation Office (ATO) website.

If you or your partner don’t need to lodge a tax return, the ATO also needs to know. Find out how to Lodge a non-lodgment advice on the ATO website.

Before you start, we recommend you work out the gross income you got in the financial year. You can find this information on your Centrelink Payment Summary or on Payment Summaries provided by your employer. These can also be found in your ATO online account in myGov.

If you’re advising non-lodgement for your partner, you’ll need to get this information from them.

The screenshots in this guide are from a computer. The screen layout will look different if you’re using a tablet or mobile device.

Step 1: get started

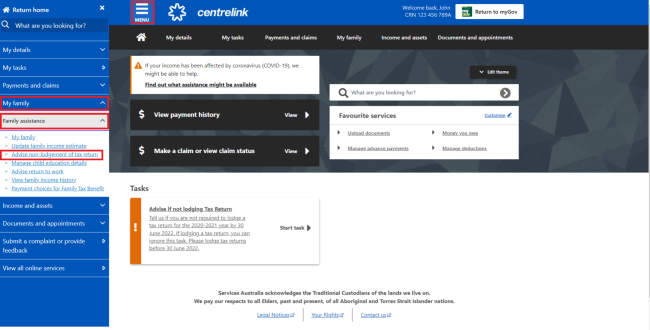

Sign in to myGov and select Centrelink.

Select MENU, followed by My Family, then Family assistance and Advise non-lodgement of tax return.

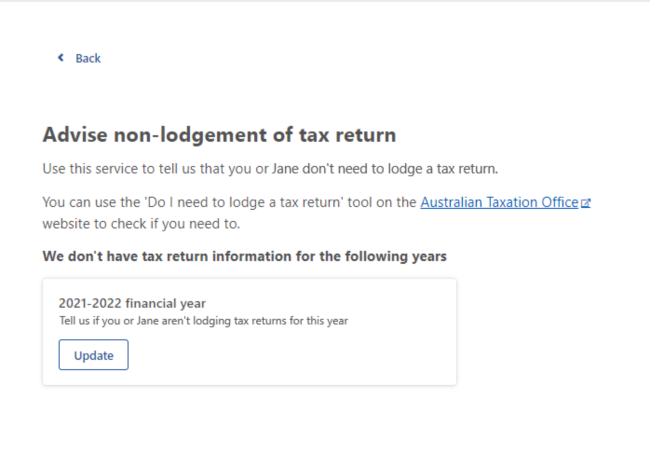

Step 2: select the financial year

Choose the financial year you need to advise non-lodgement for by selecting Update. In this example, we’ve chosen the 2021-2022 financial year.

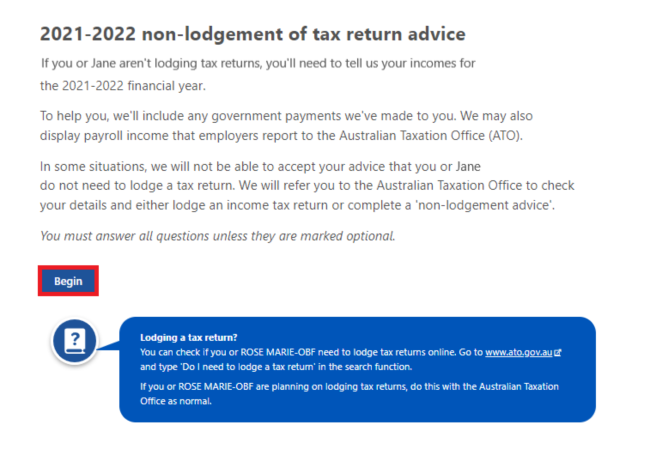

Step 3: tell us about your situation

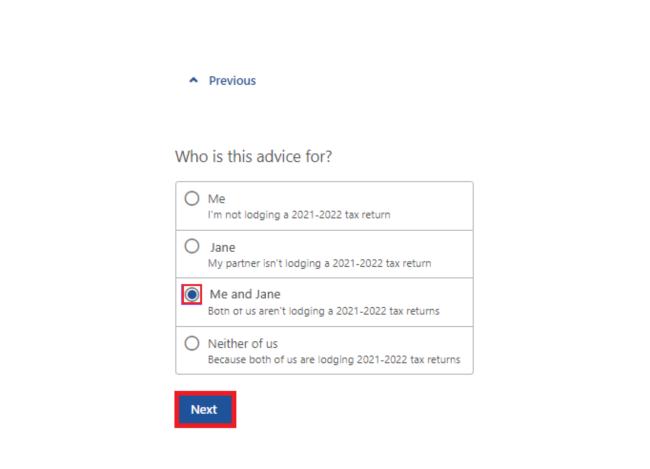

We’ll ask you if you want to update details about yourself, your partner, or both you and your partner.

If you have a partner, you’ll need to give us their answers too.

Select who doesn’t need to lodge a tax return, then Next.

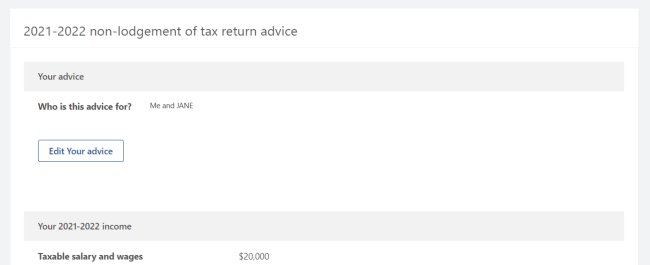

In this example we’ve selected Me and JANE.

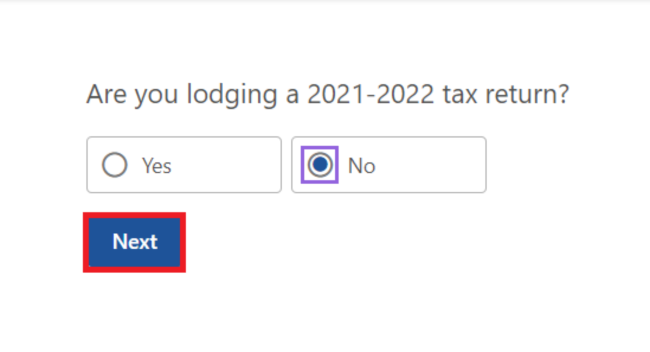

We’ll ask you if you intend to lodge a tax return. Select either:

- Yes if you intend to lodge a tax return

- No if you don’t need to lodge a tax return.

Then select Next.

In this example we’ve selected No.

Step 4: give us your income details

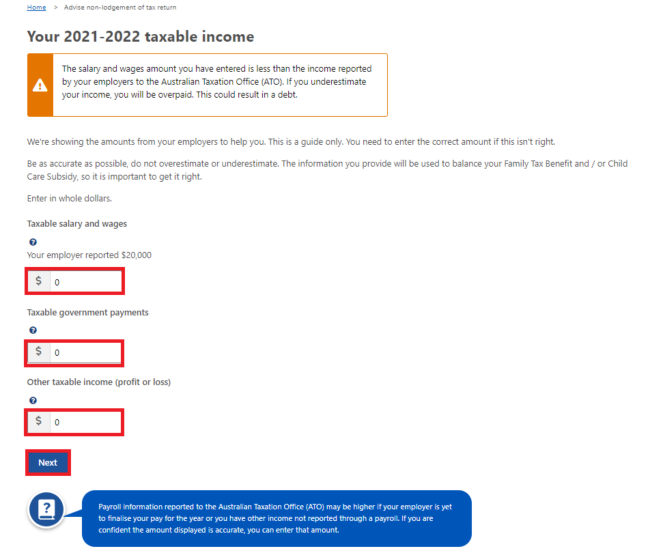

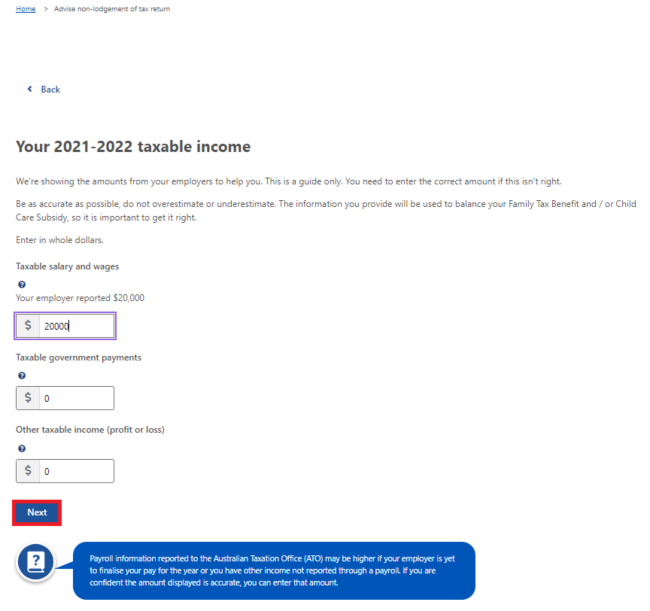

You’ll need to tell us your taxable income details.

If your employer does their payroll through Single Touch Payroll we’ll show this income as salary and wages. If you’re sure the amount shown is correct, you need to enter that amount. If it’s not correct, enter the correct amount. If the income amount shown is not correct, you should follow this up with your employer. Read more about Single Touch Payroll on the ATO website.

If you got a taxable payment from us, we’ll include this amount for you under taxable government payments. You can’t enter a lower amount than what we paid.

If you were affected by a declared natural disaster and got a government payment, you may need to include this as income.

If you got Pandemic Leave Disaster Payment (PLDP) this won’t be prefilled. You must include this amount when you confirm your income.

Read more about tax treatment of these payments at reporting disaster payments and grants in your tax return on the ATO website.

You must also add in taxable payments you got from another government department. For example, this may include certain payments from Veterans’ Affairs. Read more about government payments and allowances on the ATO website.

You might get some payments from us that aren’t taxable. You don’t need to include any of the following as part of your income details:

- Family Tax Benefit

- Child Care Subsidy

- Rent Assistance

- child support received

- Carer Allowance

- Economic Support Payments

- Cost of Living Payment

- COVID-19 Disaster Payments.

Enter the correct amount at each of the following fields:

- Taxable salary and wages

- Taxable government payments

- Other taxable income (profit or loss).

Then select Next.

Enter the correct amount in whole dollars, then select Next.

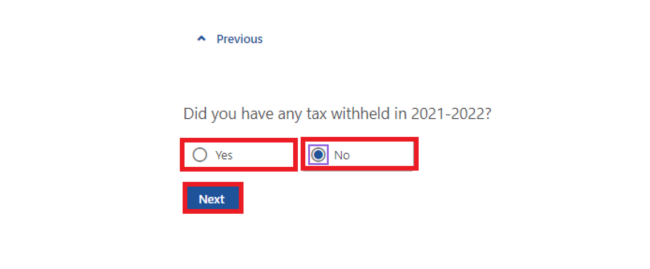

We’ll ask if you had tax withheld on any income you got in the financial year.

Select either:

- Yes if you had tax withheld

- No if you didn’t have tax withheld.

Then select Next.

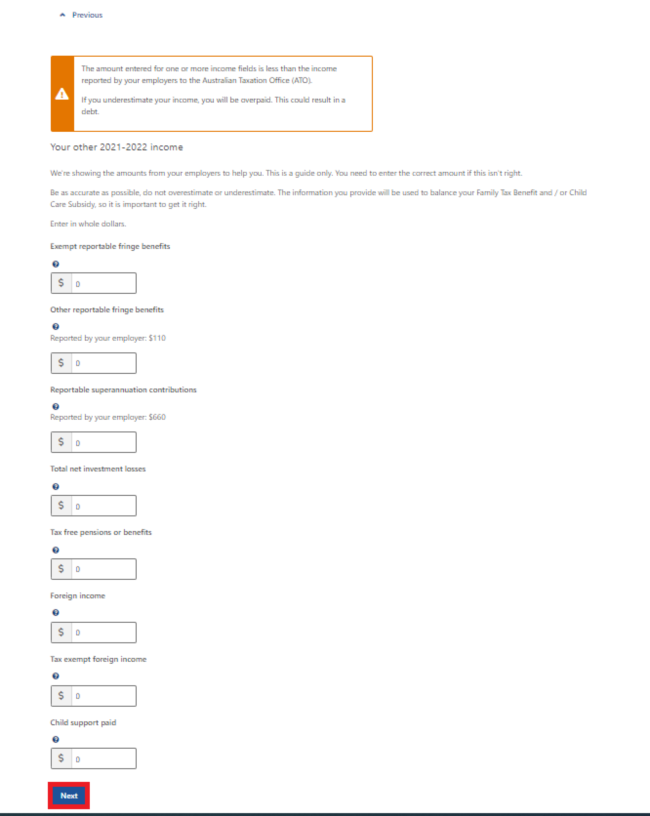

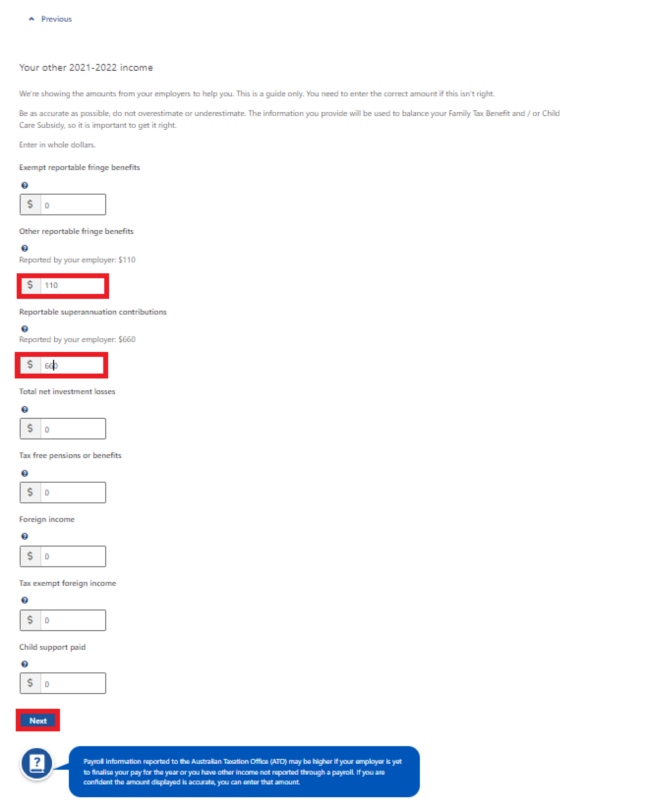

Other income details

You’ll need to tell us your other income details. If you had any other income, enter it next to the correct income type. Select the question mark icon next to the income type to read more information about it.

We may display other income from your employer that is reported through Single Touch Payroll. If you’re sure the amount displayed is correct, you need to enter that amount. If it’s not correct, enter the correct amount. If the income amount shown is not correct, you should follow this up with your employer. Read more about Single Touch Payroll on the ATO website.

If you got a Centrelink tax-free pension or benefit, we’ll include this amount for you. You can’t enter a lower amount than what we paid.

If you got tax-free payments from another government department, you may need to add these in. For example, certain payments from Veterans’ Affairs. Read more about Tax Free Pensions and Benefits.

To make updates, select the income type you want to update.

Enter the correct amounts in whole dollars, then select Next.

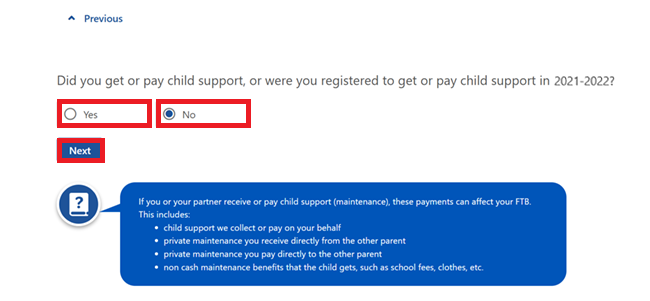

Child support income

You need to tell us if you got child support or were registered to get it.

Select either:

- Yes if you had a child support assessment or were registered to get it

- No if you didn’t have a child support assessment.

Then select Next.

If you need to:

- tell us your partner’s taxable income details, go to Step 5

- review and submit your non-lodgement details, go to Step 6.

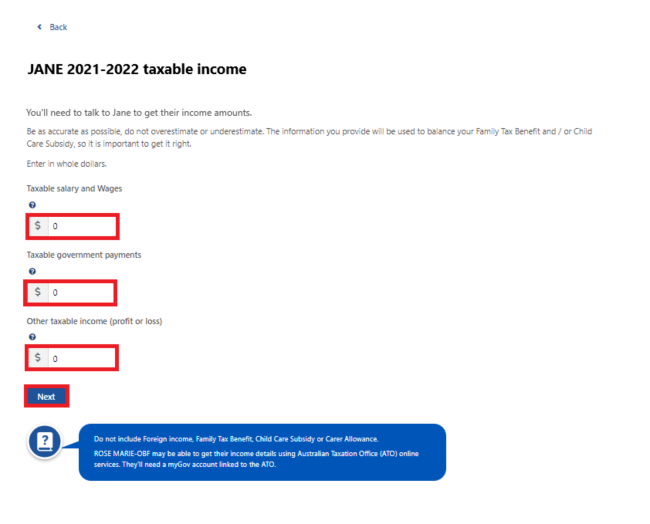

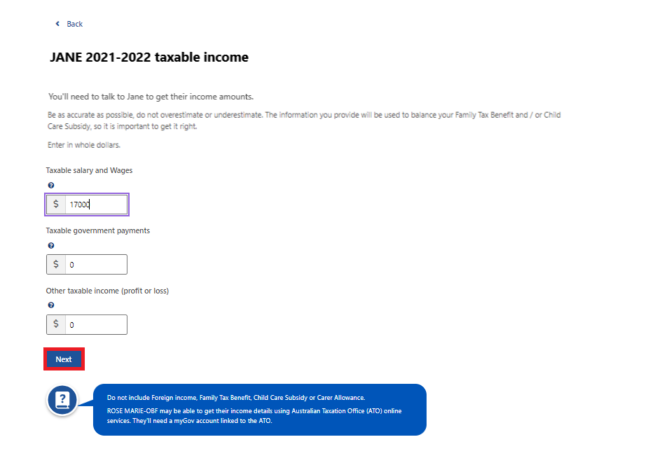

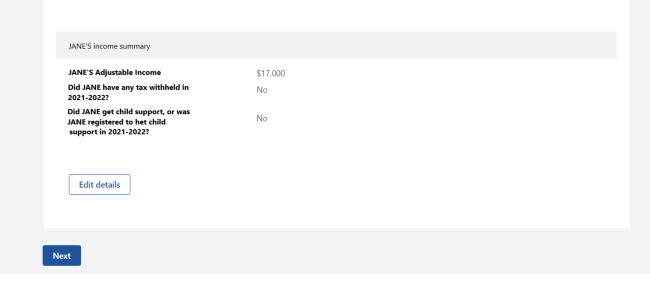

Step 5: give us your partner’s income details

You’ll need to tell us your partner’s taxable income details. If your partner had income from employment, ask them for these amounts.

If your partner got a taxable payment from us, we may include this amount for you if you have permission to view their record. You can’t enter a lower amount than what we paid.

If your partner was affected by a declared natural disaster and got a government payment, you may need to include this as income. Read more about reporting disaster payments and grants in your tax return on the ATO website.

If your partner got Pandemic Leave Disaster Payment (PLDP) this won’t be prefilled. You must include this amount when you confirm their income.

If your partner got taxable payments from another government department, you must add these in. For example, this may include certain payments from Veterans’ Affairs. Find out more about government payments and allowances on the ATO website.

Your partner might get some payments from us that aren’t taxable. You don’t need to include any of the following as part of your partner’s income details:

- Family Tax Benefit

- Child Care Subsidy

- Rent Assistance

- child support received

- Carer Allowance

- Economic Support Payments

- Cost of Living Payment

- COVID-19 Disaster Payments.

Enter the correct amount at each of these fields:

- Taxable salary and wages

- Taxable government payments

- Other taxable income (profit or loss).

Then select Next.

We’ll ask if your partner had tax withheld on any income they got in the financial year.

Select either:

- Yes if they had tax withheld

- No if they didn’t have tax withheld.

Then select Next.

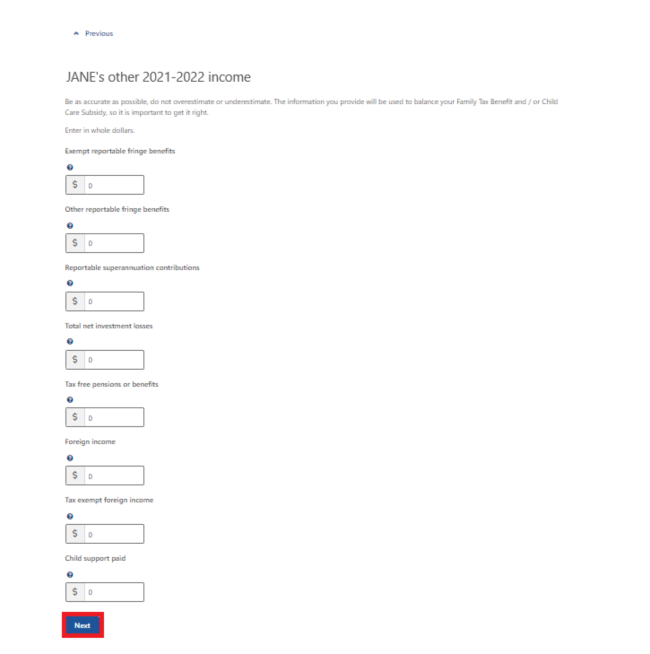

Other income details

You’ll need to tell us your partner’s other income details. If they got any other income, enter it next to the correct income type.

If your partner got a Centrelink tax-free pension or benefit we may include this amount for you if you have permission to view their record. You can’t enter a lower amount than what we paid.

If your partner got tax-free payments from another government department, you may need to add these in. For example, certain payments from Veterans’ Affairs.

Read more about Tax Free Pensions and Benefits.

To make updates, select the income type you want to update.

Then select Next.

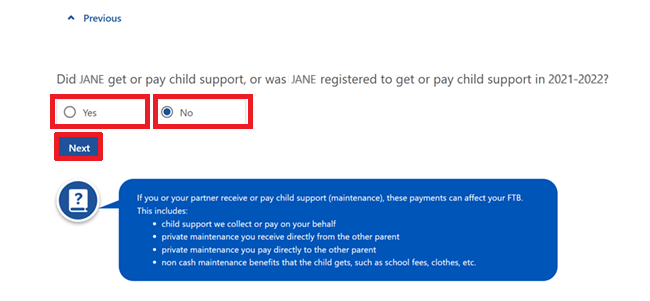

Child support income

You need to tell us if your partner got child support or was registered to get it.

Select either:

- Yes if they had a child support assessment or were registered to get it

- No if they didn’t have a child support assessment.

Then select Next.

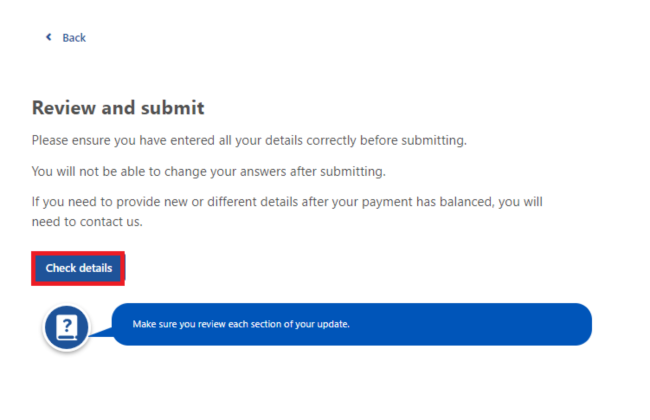

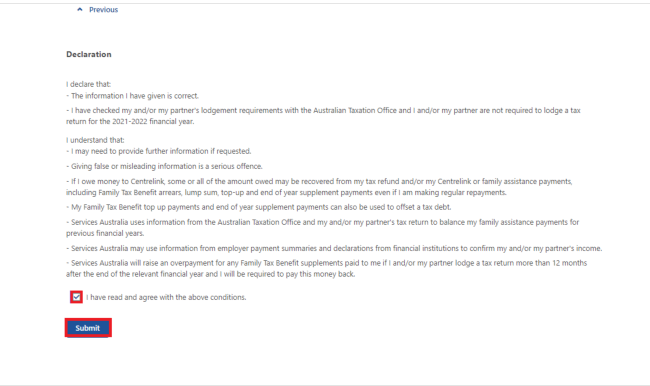

Step 6: review and submit

It’s important you check your details are correct. You may not be able to change your details after you submit them.

Select either:

- Edit Your advice or Edit details if you need to make a change

- Next to continue.

Read the declaration. If you understand and agree with the declaration, select I accept the declaration.

Then select Submit.

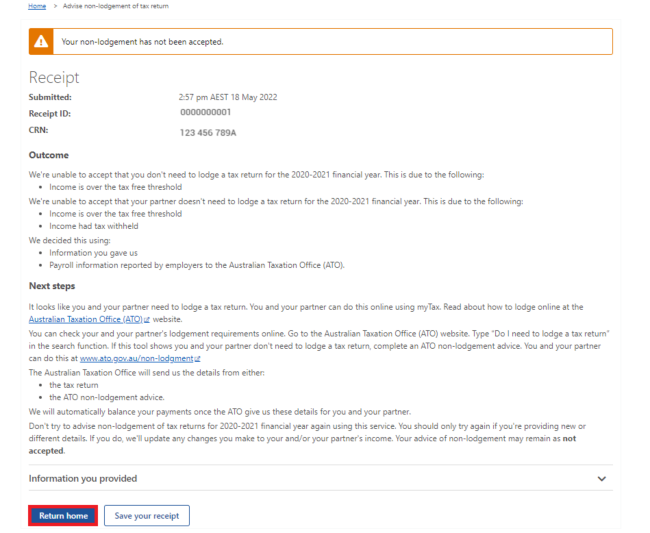

Get your receipt

We’ll give you a receipt to confirm your update has been successful. Make a note of the Receipt ID for your records.

If your non-lodgement advice is successful, we’ll use this information to balance your Family Tax Benefit and Child Care Subsidy. When we’ve balanced your payments, we’ll write to you to let you know.

You can check the status of your FTB and CCS balancing using your Express Plus Centrelink mobile app.

If your non-lodgement advice hasn’t been successful, we’ll tell you why and what the next steps will be. Make a note of the Receipt ID for your records.

If the information suggests you may need to lodge a tax return, we won’t accept the non-lodgement advice.

Select either:

- Return home to go back to your homepage, then go to Step 7 to sign out

- Save your receipt to keep a copy of your receipt.

Step 7: sign out

From your homepage, you can complete other transactions or select Return to myGov to go back to your myGov account.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus mobile app guides and video demonstrations about using your online account.