in this guide

You may have to pay tax if you get or will get any other taxable income in the tax year, such as income from employment. This guide will help you set up a voluntary tax amount we can deduct from your Centrelink payment. We’ll send these tax amounts to the Australian Taxation Office (ATO).

You can set up a deduction if you get any of the following eligible taxable Centrelink payments:

- ABSTUDY Living Allowance, if you’re 16 or older

- Age Pension

- Austudy

- Carer Payment, if you or the care receiver is of Age Pension age

- Disability Support Pension, if you’re Age Pension age

- JobSeeker Payment

- Parenting Payment

- Special Benefit

- Youth Allowance, if you’re 16 or older.

The ATO will refund any tax amount we deduct from your payment that is more than the tax you need to pay. You’ll get this at the end of the tax year.

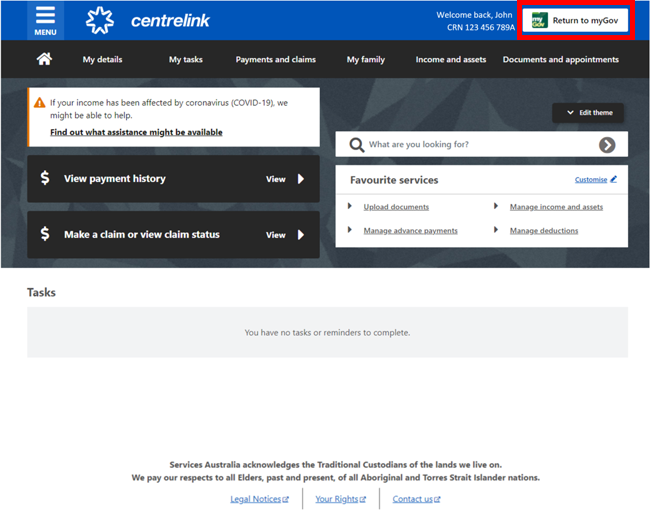

The screenshots in this guide are from a computer. The page layout will look different if you’re using a mobile device.

Step 1: get started

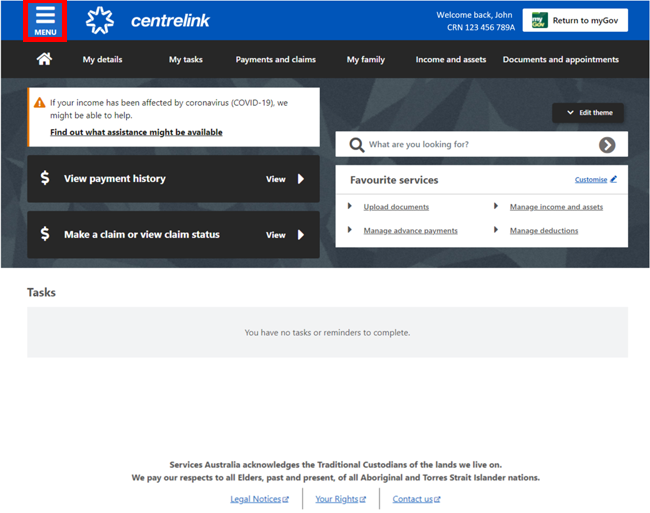

Sign in to myGov and select Centrelink.

From your homepage, select MENU.

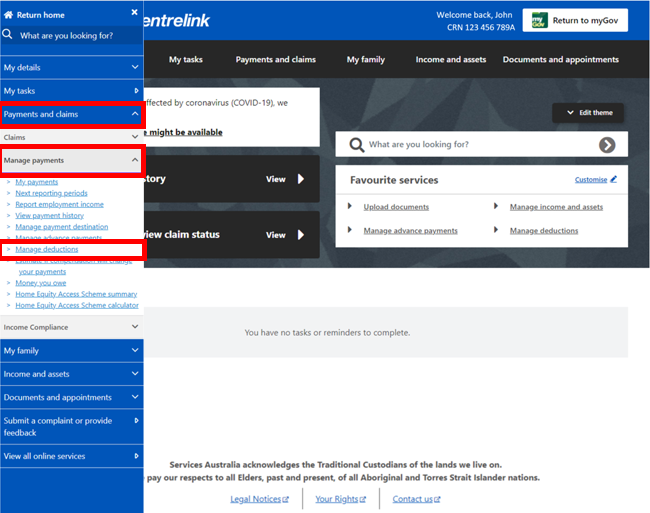

Select Payments and claims followed by Manage payments, then Manage deductions.

Step 2: add a tax amount to deduct

If you have an existing tax arrangement, go to:

- Step 3 to update your tax amount to deduct arrangement

- Step 4 to cancel your tax amount to deduct arrangement.

To add a voluntary tax amount to deduct from your payment you must both:

- be in receipt of a taxable payment

- not have an existing arrangement to deduct tax.

You can have other deduction arrangements in place. For example, you can have one or more Centrepay deductions in place but only one arrangement to deduct tax.

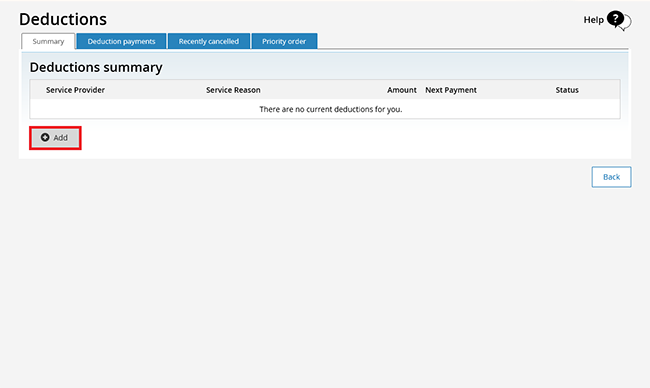

To add a tax amount to deduct, select Add. If you already have other types of deductions in place, you’ll need to select Add another.

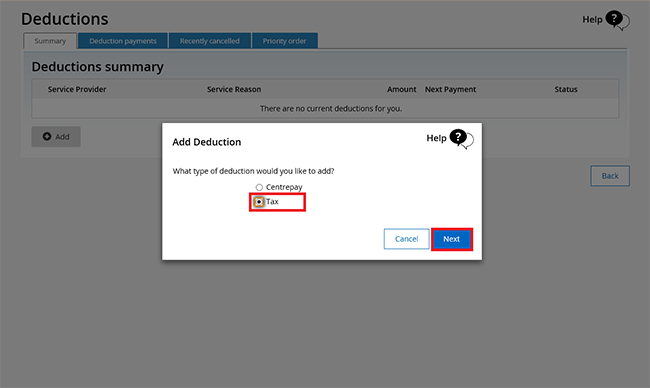

The next page will ask you to select what type of deduction you would like to add. Select Tax, then Next.

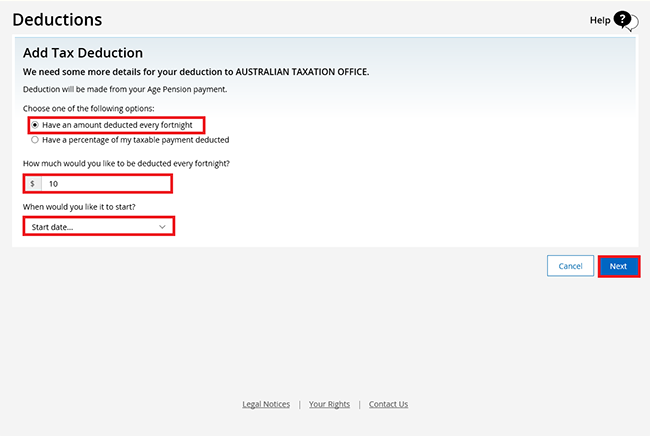

You can choose to deduct an amount or percentage of your payment.

To choose the amount to deduct, select Have an amount deducted every fortnight. Then tell us both:

- the dollar amount you want to deduct

- when you want the deduction to start.

Select Next to review and submit the tax amount to deduct arrangement.

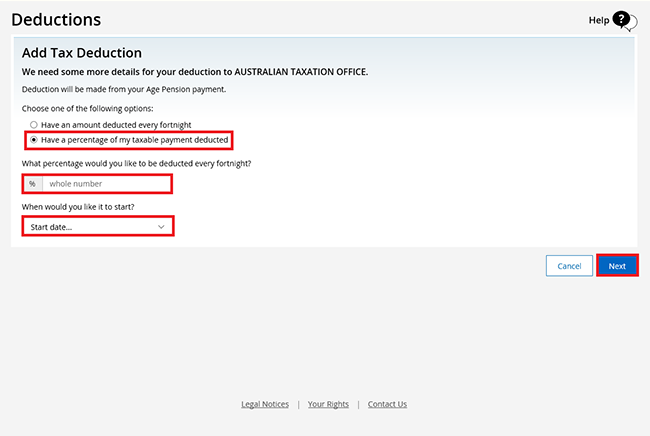

To have a percentage deducted, select Have a percentage of my taxable payment deducted. Then tell us both:

- the percentage you want deducted

- when you want the deduction to start.

Select Next to review and submit your tax amount to deduct arrangement.

Step 3: update a tax amount for us to deduct

To update a voluntary tax amount, you must both:

- be in receipt of a taxable payment

- have an existing tax amount to deduct arrangement.

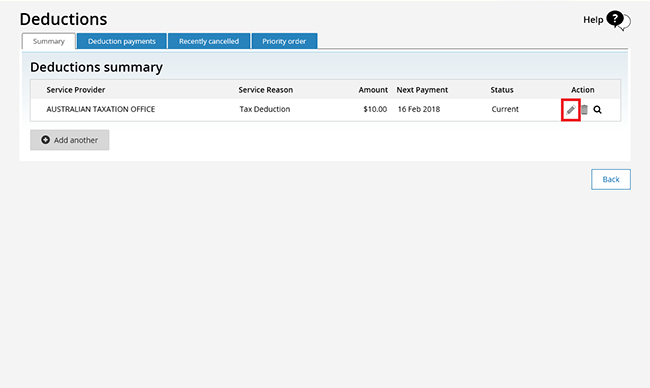

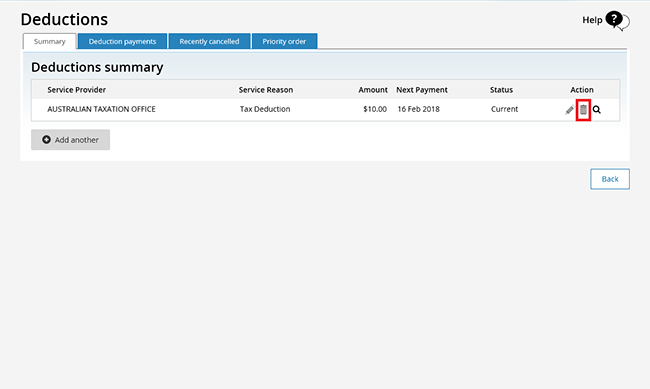

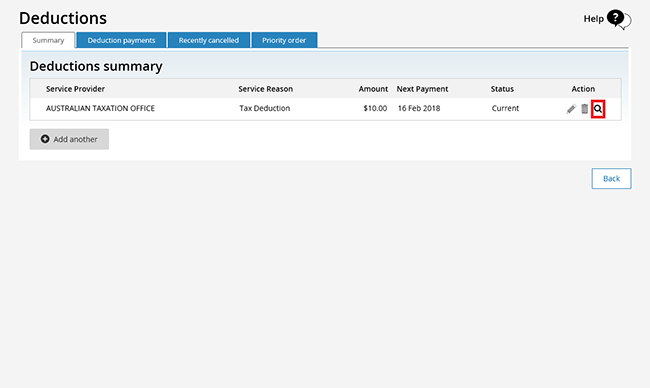

The Deductions summary page displays a summary of any current deductions you have in place.

To update your current tax amount to deduct, select the pencil icon in the Action column.

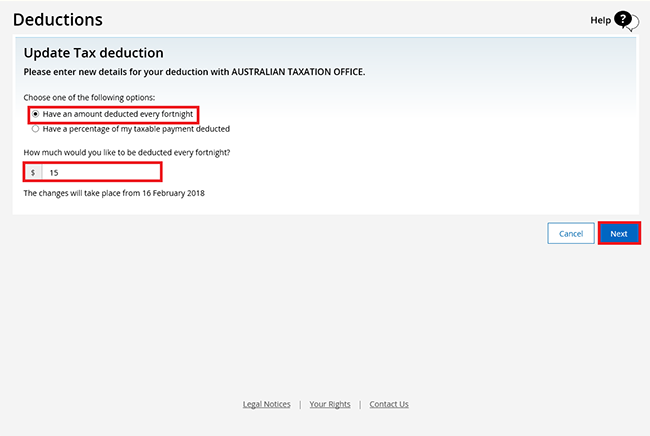

To have an amount deducted, select Have an amount deducted every fortnight. Then enter the dollar amount you want deducted.

We’ll display what date the change will take place from.

Select Next to review and submit your tax amount to deduct arrangement.

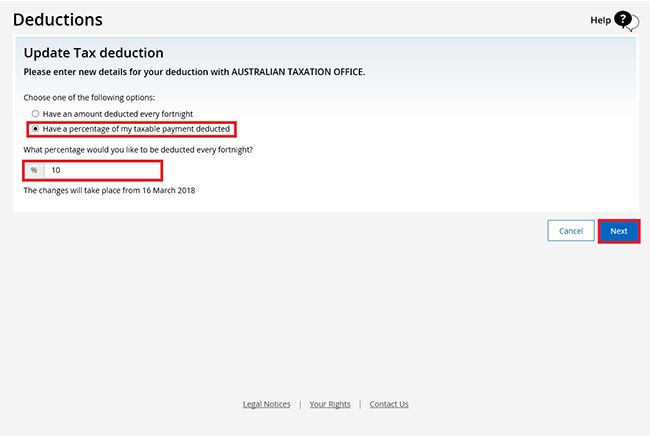

To have a percentage deducted, select Have a percentage of my taxable payment deducted. Then enter the percentage you want deducted.

We’ll display what date the change will take place from.

Select Next to review and submit your tax amount to deduct arrangement.

Step 4: cancel a tax amount for us to deduct

To cancel a voluntary tax amount to deduct arrangement, you must both:

- be in receipt of a taxable payment

- have an existing tax amount to deduct arrangement.

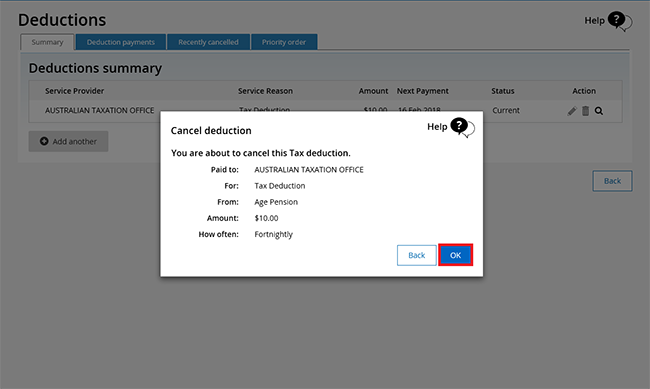

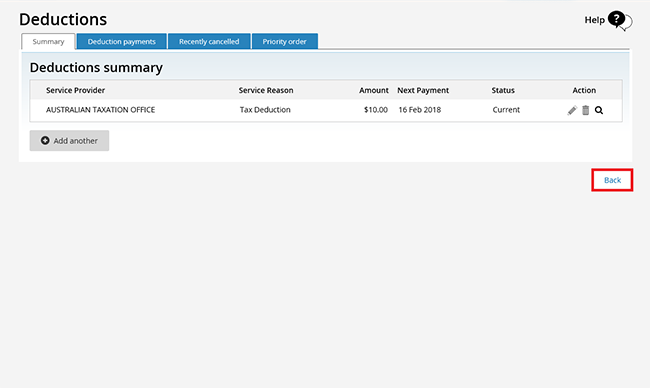

The Deductions summary page displays a summary of any current deductions you have in place.

To cancel your current tax amount to deduct arrangement, select the bin icon in the Action column.

Select OK to cancel the deduction.

Step 5: review and submit

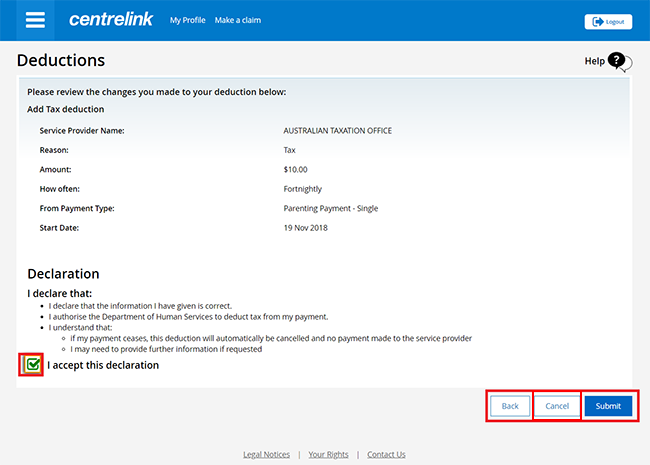

We’ll give you a summary of the details you’ve given us.

Review the details to check they’re correct.

Select either:

- Back to make changes to incorrect details

- Cancel if you don’t want to continue or need to start again.

If all the information is correct, read the declaration. If you understand and agree with the declaration, select I accept this declaration. Then select Submit.

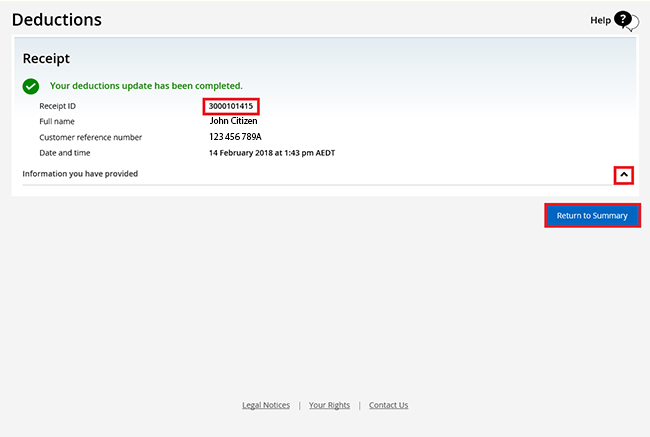

Get your receipt

We’ll give you a receipt when you submit your update. Make a note of the Receipt ID for your records.

Select either:

- Information you have provided to view a summary of the details of the tax amount to deduct

- Return to Summary to view all of your current deductions.

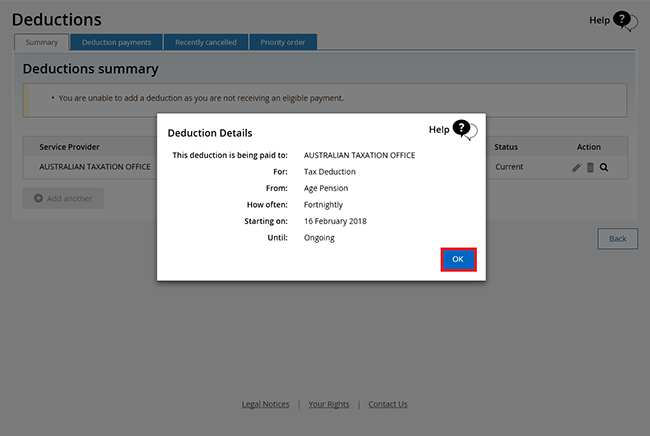

To show full details of a current deduction, select the magnifying glass icon in the Action column.

Select OK to close the deduction details.

Select Back to go back to your homepage, then go to Step 6 to sign out.

Step 6: sign out

From your homepage, you can complete other transactions or select Return to myGov to go back to your myGov account.

For your privacy and security, sign out when you’ve finished using your myGov account.

View other online account and Express Plus mobile app guides and video demonstrations about using your online account.